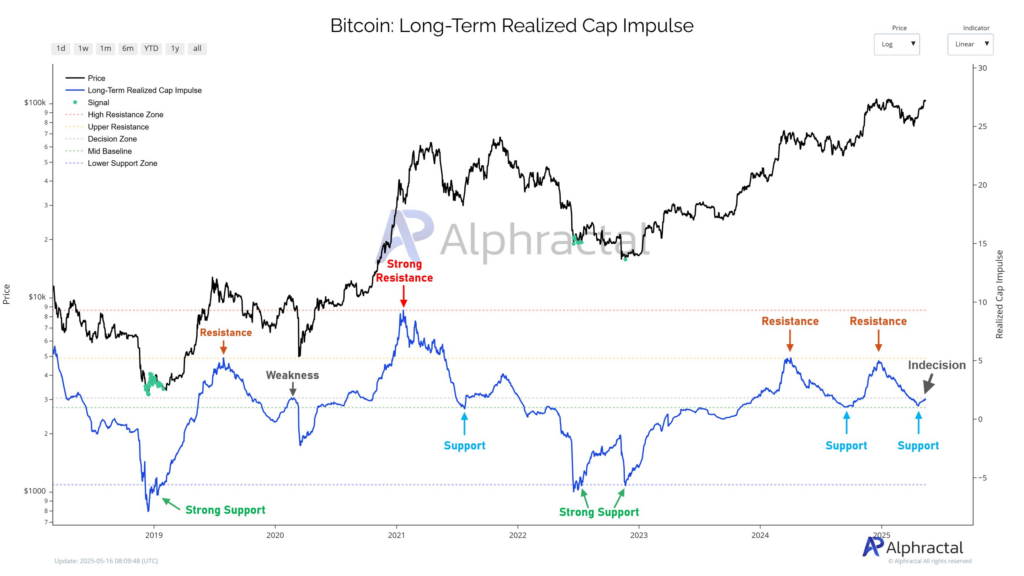

- The Long-Term Realized Cap Impulse measures Bitcoin’s supply and demand momentum, revealing essential support and resistance zones on-chain.

- Bitcoin is currently testing a historically significant Realized Cap level linked to past market reactions before the March 2020 selloff.

- A breakout from this Realized Cap zone could indicate increased demand and potential price growth based on on-chain supply dynamics.

Bitcoin is currently navigating a highly sensitive price region. Market participants are observing closely as on-chain metrics suggest potential directional movement.

Realized Cap Impulse Metric Signals Tension

According to a tweet by Alphractal, Bitcoin is positioned within a critical area identified by the Long-Term Realized Cap Impulse. This metric analyzes Realized Cap momentum and offers deeper insight into Bitcoin’s supply and demand dynamics. Horizontal line markers on the chart pinpoint historical areas of support and resistance.

Bitcoin is currently testing one such level. This zone previously served as a turning point for the market. The current test is particularly noteworthy due to the metric’s role in reflecting actual investor behavior rather than speculative sentiment.

Historical Pattern Adds Caution

Alphractal also pointed out a key historical comparison. The same price region was approached and rejected just before the March 2020 COVID-19-related market crash. That rejection marked the beginning of a sharp and sudden selloff.

This comparison is drawing cautious attention from market watchers. While a breakout above this level could suggest increasing demand, past behavior warns that rejection could once again result in accelerated downside risk. This context is vital for those managing risk in volatile markets.

Market at a Standstill: Watch or Act?

With Bitcoin moving within this crucial zone, market participants are facing a classic indecision phase. According to the on-chain data, this is not a time for impulsive action. Instead, the current moment may favor a more measured, observant approach.

Investors assessing this Realized Cap momentum zone may find it valuable to recognize how closely price interacts with long-term supply trends. A confirmed breakout would support continued accumulation and broader confidence. On the other hand, another failure at this level may introduce short-term volatility.

For now, the Realized Cap Impulse Positions Bitcoin at a crossroads. Market watchers are closely monitoring the outcome of this key test.