- Bitcoin ETFs saw $675M in total inflows on May 2, with BlackRock’s IBIT contributing nearly the entire amount, leading with $43.68B.

- BlackRock’s ETHA stands out in Ethereum spot ETFs with a $20.10M daily inflow, bringing cumulative inflows to $2.51B.

- The total volume traded in Bitcoin ETFs hit $2.90B, with investor interest focused on low-fee, trusted institutional products like IBIT.

On May 2, Bitcoin and Ethereum spot ETFs saw positive net inflows, with BlackRock emerging as the primary driver across both markets.

Bitcoin ETFs Record Strongest Single-Day Inflow of the Month

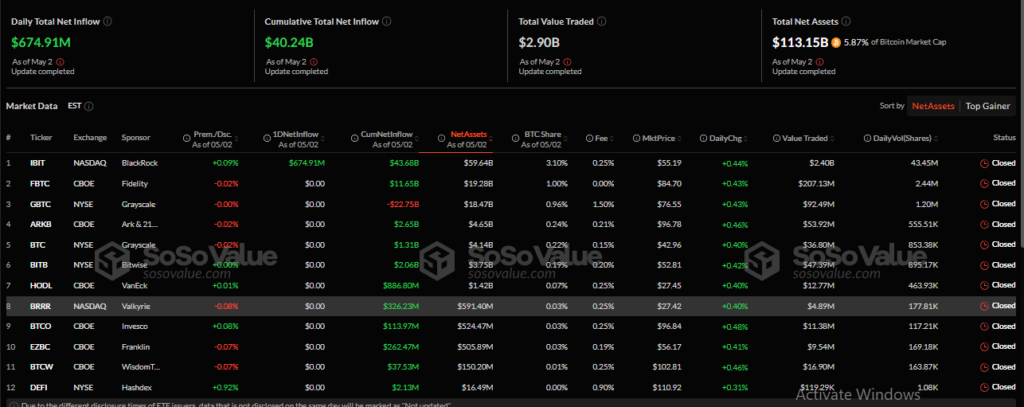

Bitcoin ETFs posted a total net inflow of $674.91 million, with all twelve funds reporting zero outflows. BlackRock’s IBIT accounted for the entire daily inflow, pushing its cumulative total to $43.68 billion. IBIT now leads the market with $59.64 billion in net assets, representing over 52% of the total Bitcoin ETF assets of $113.15 billion.

No other ETF reported inflows for the day. Fidelity’s FBTC and Grayscale’s GBTC remained flat, while GBTC continues to reflect cumulative outflows totaling –$22.75 billion. Bitwise’s BITB and VanEck’s HODL hold moderate positions, with BITB showing $2.06 billion in total inflows. Daily trading volume across all Bitcoin ETFs reached $2.90 billion, indicating strong institutional participation.

Ethereum ETFs Report Moderate Inflows Led by ETHA

Ethereum ETFs saw a combined net inflow of $20.10 million, bringing total cumulative inflows to $2.51 billion. BlackRock’s ETHA accounted for the full day’s inflow, reinforcing its position as the dominant Ethereum ETF. ETHA now holds $2.33 billion in net assets and recorded $84.49 million in daily trading volume.

Other funds showed flat activity, with no inflows reported by ETFs from Fidelity, Bitwise, or VanEck. Grayscale’s ETHE continued to post negative performance, now showing –$4.30 billion in cumulative net outflows. The total value traded across all Ethereum ETFs stood at $153 million, a fraction of Bitcoin ETF trading activity.

Institutional Flows Favor Low-Fee, Large-Scale Funds

The ETF market continues to show a strong preference for established fund managers offering low fees and institutional-grade trust. BlackRock leads across both Bitcoin and Ethereum ETF products, controlling a large share of investor capital. Ethereum ETF adoption, while growing, remains comparatively smaller, holding only 2.87% of Ethereum’s market cap compared to Bitcoin’s broader ETF adoption footprint.