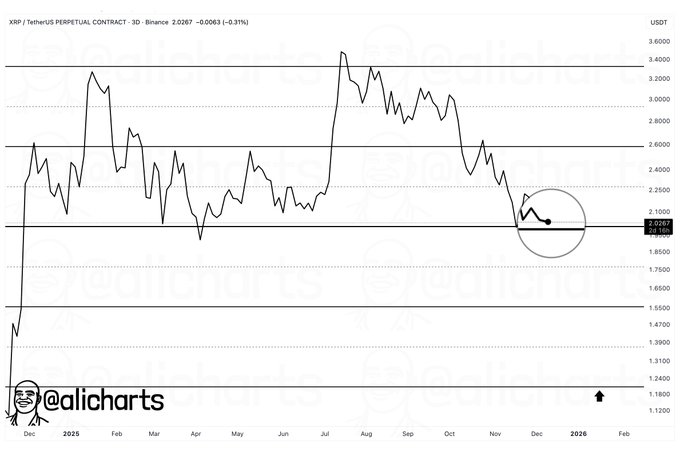

- XRP consolidates near $2 after months of weakening structure and repeated upper resistance failures

- Selling pressure increased after rejected rallies above $3 earlier in 2025

- Short-term stability masks elevated downside risk if $2 support breaks

XRP centers on a critical support test as the asset trades near $2.03. Market structure reflects consolidation after prolonged weakness, with traders monitoring whether this level holds or fails.

XRP Faces a Defining Test at the $2 Level

XRP is positioned at a technically important zone, with the $2 level acting as both psychological and structural support. A recent post from Ali (@alicharts) emphasized that XRP must hold this area to avoid a potential decline toward $1.20. The three-day chart reinforces that assessment, showing price compressing just above this threshold.

Earlier market cycles established $2 as a reference point for buyer defense. As price approaches this zone again, hesitation is visible, suggesting traders are awaiting confirmation. Sustained acceptance above $2 may stabilize conditions, while any decisive loss risks triggering accelerated selling activity.

Prior Rallies Failed to Shift XRP Structure

The XRP showed a solid move in December 2024 into the early part of 2025, reaching the target of $3.20-$3.40. That move was met with heavy supply, forming a major resistance band that shaped subsequent trading behavior. The rejection marked the start of a broader corrective phase.

Between February and June 2025, XRP moved sideways within a $2.20–$2.80 range. This period reflected balance rather than strength, as buying interest failed to expand. A breakout attempt in July briefly pushed price above $3.40, yet the move quickly reversed, signaling exhaustion and renewed distribution.

Short-Term XRP Activity Shows Balance, Not Strength

Recent intraday data shows XRP trading within a narrow $1.98–$2.04 band. An early session decline toward the lower boundary attracted responsive buying, allowing price to reclaim $2. However, repeated approaches toward $2.04–$2.05 faced steady supply.

These shallow pullbacks suggest sellers are active but not dominant. XRP’s market capitalization near $122.7 billion and daily volume around $2.6 billion confirm ongoing engagement rather than capitulation. Still, upside momentum remains limited without acceptance above near-term resistance.

The current structure leaves XRP vulnerable to volatility. Holding $2 preserves short-term stability, while failure could open a path toward lower historical demand zones. Until a clear reaction unfolds, XRP remains range-bound, with the $2 level guiding near-term direction and trader positioning.