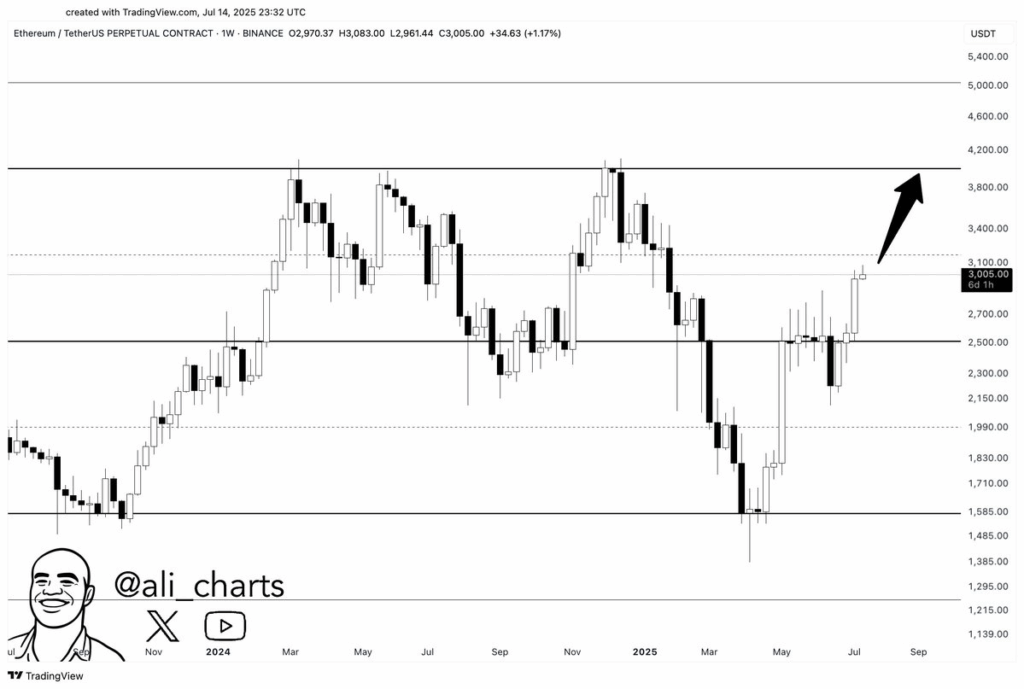

- Ethereum has confirmed a weekly breakout above the $2,800 zone, signaling renewed bullish structure after prolonged price consolidation.

- A clear move above $3,980 may lead Ethereum toward $4,600–$5,400 as past breakouts from this level triggered rapid rallies.

- ETF inflows into Ethereum reached historic highs, showing rising institutional interest as the asset maintains a strong upward trajectory.

Ethereum is once again well-positioned after breaking out of an extended range of consolidation and is now pushing towards a significant level of resistance at $3,980. The breakout above $2,800, which had acted more of a strong barrier, is a signal of strengthening market conditions.

Weekly Structure Signals Macro Shift

Ethereum (ETH) has officially broken above the long-held resistance between $2,700 and $2,800. This range had capped upward movement throughout early 2025. The current weekly candle, trading above $3,000, reflects growing bullish momentum in the ETH/USDT pair.

This structural breakout shows a continuation of higher highs and higher lows, potentially reversing the macro trend. The $3,980 level has served as a pivot point, interrupting many bull runs in early 2024. If Ethereum breaks out of this resistance, prior price history indicates a potential for fast gains, with price targets in the $4,600 to $5,400 range.

Technical validation above $3,980 could neutralize the current bearish bias. In previous cycles, this number served as a launching pad into the new price ranges, triggering both institutional and retail inflows.

Largest ETF Inflows Ever Recorded

Crypto Rover stated on social media that Ethereum just recorded its largest ETF inflow ever. This development is seen as a major driver supporting the ongoing momentum behind ETH’s recent breakout.

Such inflows typically reflect renewed institutional confidence in the asset. Combined with the favorable technical structure, this capital rotation may reinforce Ethereum’s advance toward the $3,980 mark. If this trend continues, the asset could enter a fresh phase of upward price discovery.

As seen from the on-chain analysis the current daily trading volume of Ethereum stands at over $50 billion. The price of ETH has risen 9.06% in the last 24 hours and 23.59% over the course of the past seven days establishing short-term buying pressure.

$3,980: The New Technical Battleground

Ali (@ali_charts) emphasized on X that $3,980 is the next critical resistance for Ethereum. This level represents the top of several previous swing highs and is seen as a decisive barrier.

If the market rejects ETH at $3,980, traders may anticipate a pullback toward the $2,700–$2,800 zone. This now acts as support and a crucial point for maintaining the bullish trajectory. However, a confirmed breakout above this range would likely accelerate Ethereum’s rally.

ETH’s recovery from $1,585 and the current uptrend pattern support the ongoing bullish structure. As Ethereum approaches the key resistance zone, all eyes remain on market reaction at the $3,980 level.