- According to CryptoQuant, Bitcoin holders made more profit only up to 0.26 million BTC, which means that the accumulation is undergoing despite new all-time highs.

- Long-term holders traded only 5,000 BTC this month, which is a sign of solid belief since gains are not as high as they are during a typical market top.

- CryptoQuant estimates Bitcoin to hit between $160,000 and 200,000 in the next few months when the holding patterns and investor demand is constant.

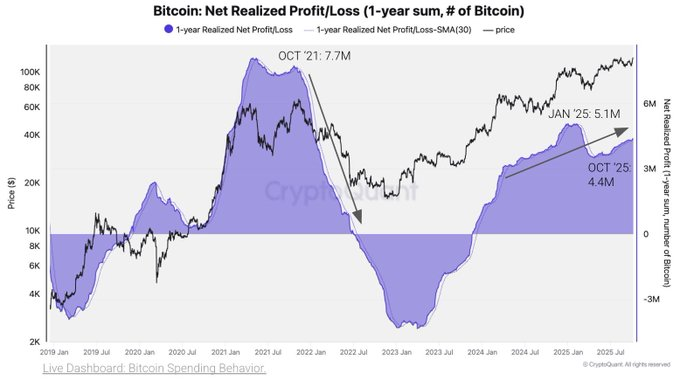

Profit-taking in Bitcoin remains limited even as the cryptocurrency climbed to new all-time highs above $126,000 this week, according to onchain analytics firm CryptoQuant. The firm’s latest report suggests that most holders continue to accumulate rather than sell, indicating that the current rally may have further room to run.

Low Realized Profits Indicate Continued Accumulation

CryptoQuant’s report shows that Bitcoin holders realized a total of 0.26 million BTC in profits over the past 30 days — about $30 billion in value. This is roughly half of July’s 0.53 million BTC ($63 billion) and well below the $78 billion and $99 billion peaks recorded in March and December 2024, respectively. The firm stated that these low realized profits signal that “bitcoin may continue to rally, and that a top is still not on the horizon.”

Julio Moreno, CryptoQuant’s head of research, noted that realized profit momentum remains a reliable indicator of price trends. “As long as there’s positive momentum on realized profits — holders taking profit at higher levels — it indicates that prices may trend upward,” he said.

Moreno further explained that the market usually shows signs of exhaustion when realized profits begin to decline. “In the past, bull markets have ended as holders sell into lower realized profits,” he added, pointing to the current data as evidence of continued market strength.

Long-Term Holders Show Little Selling Pressure

Data also indicate that long-term Bitcoin holders are keeping their coins dormant. CryptoQuant noted that spending from “OG” addresses — wallets holding BTC for over ten years — remains subdued, with only 5,000 BTC moved in the last 30 days. This is half of what was sold during the March and December 2024 peaks and 29% lower than May 2025 levels.

Short-term holders are also realizing smaller gains. According to CryptoQuant, recent profit margins for this group stand near 2%, well below the 8% levels typically linked to market tops. In comparison, long-term holders’ realized margins are around 129%, far from the 300% peaks historically seen during overheated cycles.

The muted profit-taking and absence of long-term holder activity show that conviction in the ongoing uptrend remains intact. With selling pressure limited, market participants appear to be sure that Bitcoin’s rally can extend further.

Market Outlook Points Toward Continued Upside Potential

CryptoQuant maintains that Bitcoin’s positive profit momentum and low realized gains support the case for continued appreciation into the fourth quarter. The firm recently projected that, if demand persists, Bitcoin could reach between $160,000 and $200,000 in the coming months.

Traditional financial institutions share similar optimism. Analysts at JPMorgan stated that Bitcoin remains underpriced relative to gold, which could mean upside to $165,000. They attributed this opinion to “retail investors taking up the debasement trade through ETF inflows,” giving Bitcoin added solidity as a hedge against monetary dilution.

Together, CryptoQuant’s data and institutional analysis indicate a resilient market. With realized profits low and long-term holders largely inactive, current conditions show few signs of a market top, hinting that Bitcoin’s bull run could still have considerable distance to go.