- Historically Bitcoin dominance slip signals investor rotation from Bitcoin into alternative cryptocurrencies seeking higher returns.

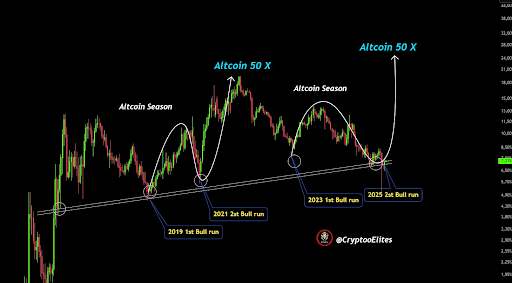

- Analysts point to a repeating market rhythm where every second bull run triggers major altcoin rallies,and a similar early pattern is forming.

- The crypto market remains consolidated before a potential altcoin-driven growth phase later in 2025.

Bitcoin dominance has dropped near its 50-week Exponential Moving Average (EMA).Traders are viewing this move as an early sign of renewed altcoin momentum citing a potential change in capital flow within the crypto market.

Bitcoin Dominance Near Key Technical Level

BTC.D is a metric representing Bitcoin’s market share relative to the total cryptocurrency capitalization, it currently stands at 59.3% down slightly from 60 per cent last week.

Historically, declines below the 50-week EMA have aligned with periods when investors shifted funds toward alternative digital assets.According to market data, the 2025 setup appears similar to early 2021, when Bitcoin’s dominance weakened, and altcoins recorded exponential gains.

Merlijn The Trader, a well-known market analyst, noted in a recent post on X (formerly Twitter) that “Bitcoin dominance just broke. Every time this happens… Altcoins explode.” His chart analysis indicates a potential transition toward a new altcoin cycle.

Bitcoin’s market control has fluctuated between 40% and 60% since 2019, earlier surges above the 50 EMA, in early 2023, marked Bitcoin-led rallies.

Market Patterns Indicate Rotational Behavior

Analysts have identified a repeating cycle in market behavior. Every second bull run since 2019 has triggered strong altcoin rallies. Data shows a 50x surge in 2021 following Bitcoin’s dominance breakdown.

If this rhythm continues, 2025 could be the next period of pronounced altcoin performance.

The pattern presented by Merlijn The Trader outlines four major phases: 2019 as the first bull run, 2021 as the second with major altcoin appreciation, 2023 as another Bitcoin-led phase, and 2025 potentially loading for a repeat.

Source Merlijn The Trader

This sequence has not failed to appear across recent market cycles. The recurring structure suggests that traders may be preparing for rotational capital shifts from Bitcoin to altcoins.Confidence is building as the broader market recovers and risk appetite increases.

Market Conditions Reflect Consolidation Phase

The global cryptocurrency market,recorded a modest 1.5% dip over the last 24 hours,Bitcoin is trading near $103,299, and Ethereum at $3,444.XRP and BNB have remained steady, changing hands at $2.39 and $955.55, respectively.

At the same time, smaller-cap coins such as Firo, Zcash, and Uniswap continue to attract selective investor attention, reflecting a market that’s cooling slightly but still active across multiple sectors.Surge, Nano, and Overtake lead with double-digit gains, signaling selective investor activity.

Despite short-term declines, liquidity remains stable with Tether’s daily volume exceeding $96 billion. If Bitcoin dominance continues to weaken below the 55% level, analysts anticipate renewed momentum across the altcoin market heading into late 2025.