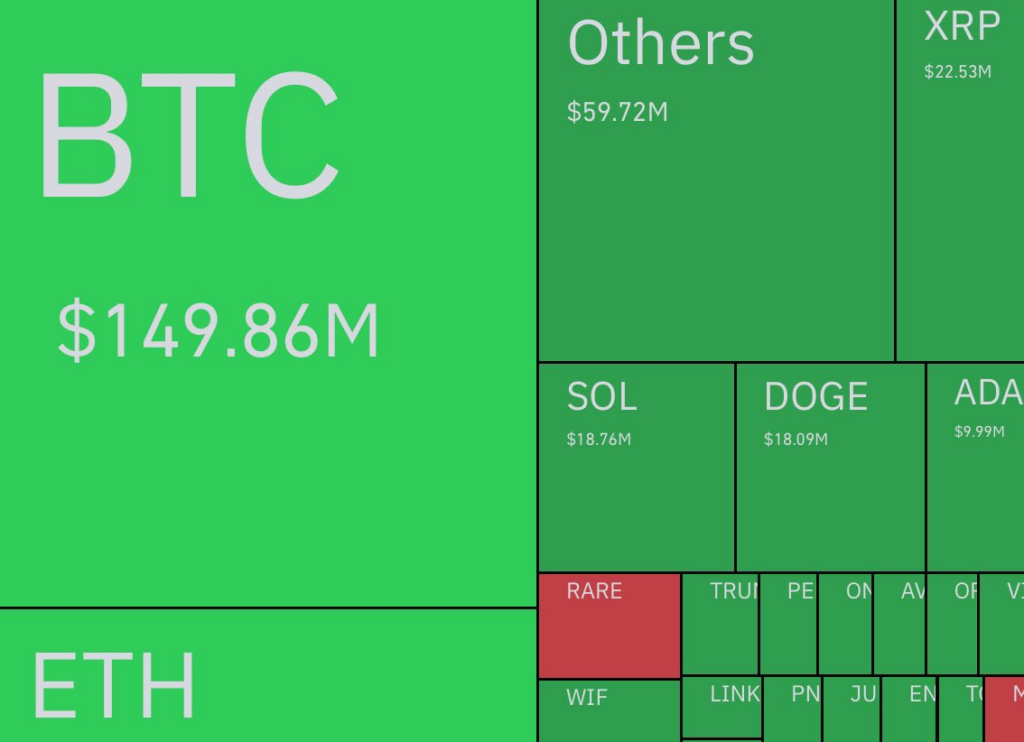

- Bitcoin attracts $149.86M in inflows during the liquidation event, indicating robust investor commitment and prompt capital reallocation in the volatile crypto market.

- Altcoins such as Ethereum, Solana, Dogecoin, and XRP register substantial inflows, while investors steadily diversify into emerging tokens in the ‘Others’ category.

- Despite RARE underperforming, overall market dynamics consistently show a swift reallocation of funds, ensuring recovery trends persist across major cryptocurrencies amid volatility.

The digital asset market witnessed a $452 million 24-hour liquidation that signifies the level of volatility. Despite this, massive inflows into the major assets show that traders are still reinvesting, with Bitcoin being the most favored. Market participants are strategically repositioning funds and re-establishing confidence in digital assets.

Bitcoin Captures the Spotlight as Market Bounces Back

Bitcoin saw $149.86 million in inflows, demonstrating a strong recovery despite the event of liquidation. Investors have proven to deposit the funds that have been liquidated into BTC since it is a safer asset among the crypto markets. The inflow demonstrates that the players in the markets still have hope for the long-term prospects of Bitcoin.

The capacity of the market to digest big-scale liquidations without long-term downturns demonstrates resilience. Whereas liquidations usually occur due to overleveraged positions, panic selling, or adjustment phases, BTC’s robust recovery suggests that traders perceive price drops as buying opportunities.

Altcoins Experience Strong Inflows Despite Volatility

Ethereum (ETH), Solana (SOL), Dogecoin (DOGE), and XRP also registered significant inflows, reflecting continued investor demand. SOL had $18.76 million and DOGE had $18.09 million, reflecting traders’ confidence in established alternative coins.

The “Others” segment accounted for $59.72 million, showing a reallocation of funds into smaller or emerging cryptocurrencies. This suggests that investors want to diversify due to the event of liquidation. Alts still offers an attractive alternative to traders who do not want to focus solely on Bitcoin.

RARE Struggles as Market Rebalances

While the majority of the assets witnessed positive inflows, RARE was the one that stood out in the red, reflecting a downturn in buyer confidence. The asset’s woes could be attributed to direct liquidations, selling pressure, or market uncertainty over its performance.

Despite this, overall sentiment in the market is upbeat. The ability of Bitcoin and leading altcoins to attract inflows post-liquidation process is an indicator of a better outlook. The next 24 to 48 hours will decide if the market holds its recovery or witnesses more volatility.