- Tether minted $1B USDT on Ethereum to boost liquidity while facing a $4.8M debt dispute in Uruguay over unpaid energy bills.

- Stablecoin volumes surged from under $50B in 2019 to nearly $1T in 2025 with USDT leading at 60–70 percent dominance globally.

- Despite debt tensions in Uruguay, Tether reinforced its global role as the backbone of liquidity and stablecoin adoption across markets.

Tether has minted $1 billion USDT on Ethereum, adding fresh liquidity and reinforcing the blockchain’s position as the primary hub for stablecoin issuance.

According to CryptoBusy, this injection boosts market depth during a time when stablecoin demand continues to surge globally. However, the milestone coincides with reports of financial strain in Uruguay, where Tether faces a $4.8 million debt dispute.

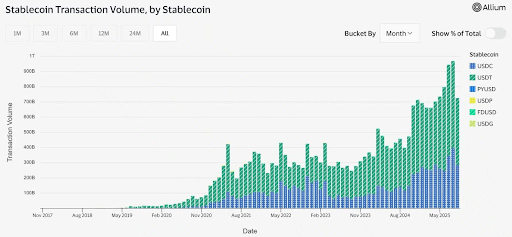

Besides the minting news, the Stablecoin Transaction Volume chart shows exponential growth across the ecosystem since 2017. Monthly transaction activity climbed from under $50 billion in 2019 to nearly $1 trillion by early 2025.

USDT consistently dominated volumes, capturing 60–70% of global transactions. Consequently, Ethereum’s role as a stablecoin hub remains central to this long-term growth story.

Stablecoin Market Dynamics

Moreover, USDC maintained 25–35% of market share during peak periods, making it the second most significant contributor. Other stablecoins, including PYUSD, FDUSD, USDP, and USDG, collectively stayed below 10% of total volumes. This concentration highlights Tether’s unmatched influence over global stablecoin flows.

Additionally, adoption surged after 2020 as DeFi expansion and institutional entry fueled growth. Monthly volumes ranged between $200 billion and $400 billion during that period. Since then, activity steadily climbed, reflecting mainstream reliance on stablecoins as tools for value transfer and liquidity management.

The Uruguay Challenge

However, Tether’s Uruguay operations faced turbulence. Local outlets reported unpaid electricity bills and other liabilities totaling $4.8 million. The National Administration of Power Plants and Electric Transmissions (UTE) even cut power to mining facilities over a $2 million unpaid bill. Reports suggested that Tether had abandoned its operations in the country.

Tether denied these claims, saying: “We continue to evaluate the best way forward in Uruguay and the region more broadly.” The company acknowledged ongoing debt discussions, adding: “Tether remains supportive of these efforts and of a constructive path forward.” Hence, the company positioned the dispute as a temporary friction rather than an exit.

Tether continues to dominate stablecoin markets with new capital injections, but the Uruguay debt standoff shows the challenges of balancing global growth with local operations.