- SOL trades within a broad accumulation zone while remaining under a major descending trendline.

- Price approaches a resistance confluence near $144 as demand builds through repeated range tests.

- Institutional inflows and rising network activity support growing attention toward Solana’s market structure.

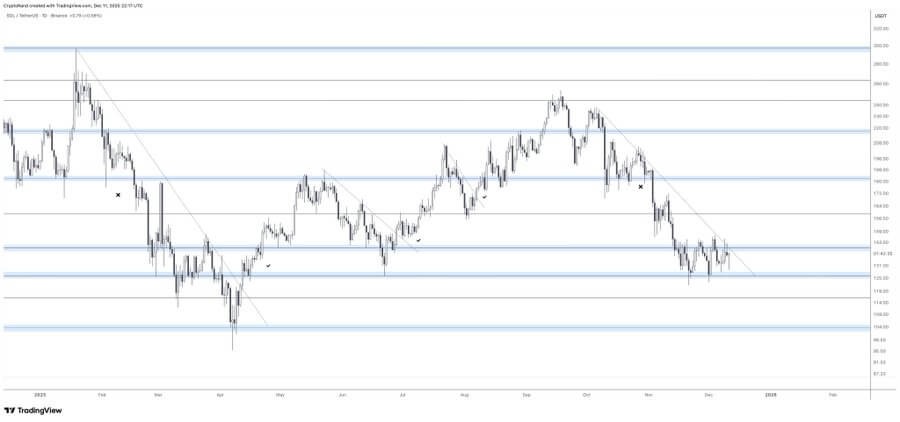

Solana continues to trade inside a wide consolidation area, and the market stays below its major descending trendline. Price action moves within the accumulation phase as traders watch the approaching trendline. According to the analysts “once the trendline breaks, we can expect +50% Bullish Rally so keep accumulating,” though this remains part of the chart’s internal text.

SOL Still Moving Inside the Accumulation Phase

Solana continues to trade inside a fixed range near its recent lows, and the market shows steady swings between the defined boundaries. According to analysis prepared by Captain Faibik, price action holds inside a broad accumulation box while the descending trendline presses down from above.

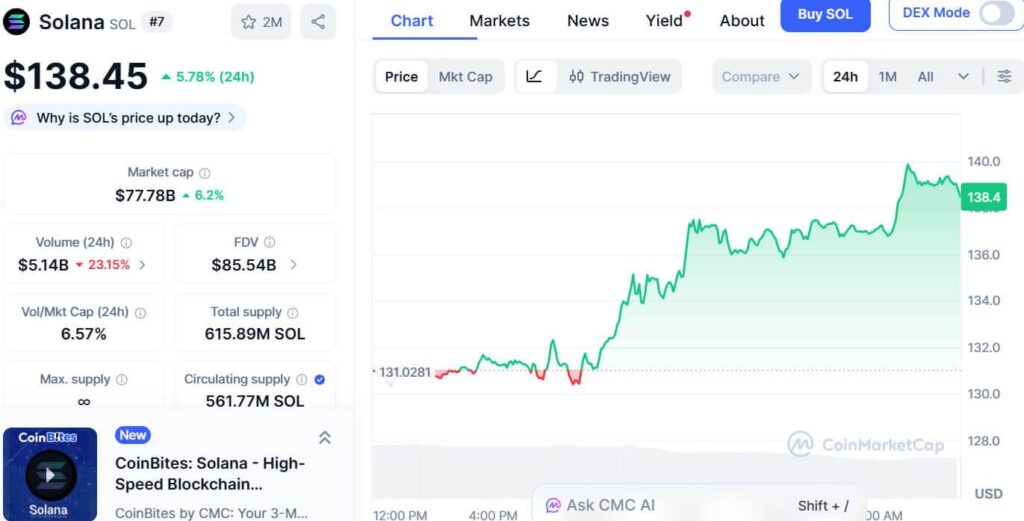

The upper boundary faces repeated tests as buyers lift the price toward the ceiling, yet the trendline still restricts progress. Market data places SOL at $138.45 after a gain of 5.78% in the last day, and the market cap rises to $77.78 billion. Trading volume reaches $5.14 billion, though it shows a daily drop of 23.15%.

During the monitored period, Solana begins near $131.02 and moves higher with steady demand. The structure forms clean higher lows, and these levels build a controlled upward path. Buyers guide each rotation through small consolidation areas, and the session ends near $138.4 with price holding near the upper region of the daily range.

Trendline Confluence Near Resistance Levels

SOL remains below the trendline that connects earlier lower highs, and this barrier keeps the market inside the accumulation phase. According to an observation by CryptoRand, SOL now trades near a major confluence where the horizontal range ceiling meets the descending trendline. The analyst notes that a move over the $144 region would mark a full reversal zone on the chart.

Institutional inflows continue to raise attention as Solana ETFs register $16.6 million in new allocations. The network also records strong application revenue above 3.6 million in the last day, and this strengthens ecosystem activity.

Coinbase adds support for on-chain swaps through its Solana-powered DEX, and this step improves access for retail and institutional users. Invesco Galaxy also moves toward its Solana ETF launch after filing Form 8-A with the SEC, and this event may influence market behavior once broader conditions stabilize.