- Ali projects a weekly close above $260 could send Solana toward a $520 cycle peak.

- ZYN notes three straight gains using a 25% dip buy and 50%-60% rally exit method.

- Support sits at $160, with deeper buffers near $120 and $40 if rejection occurs.

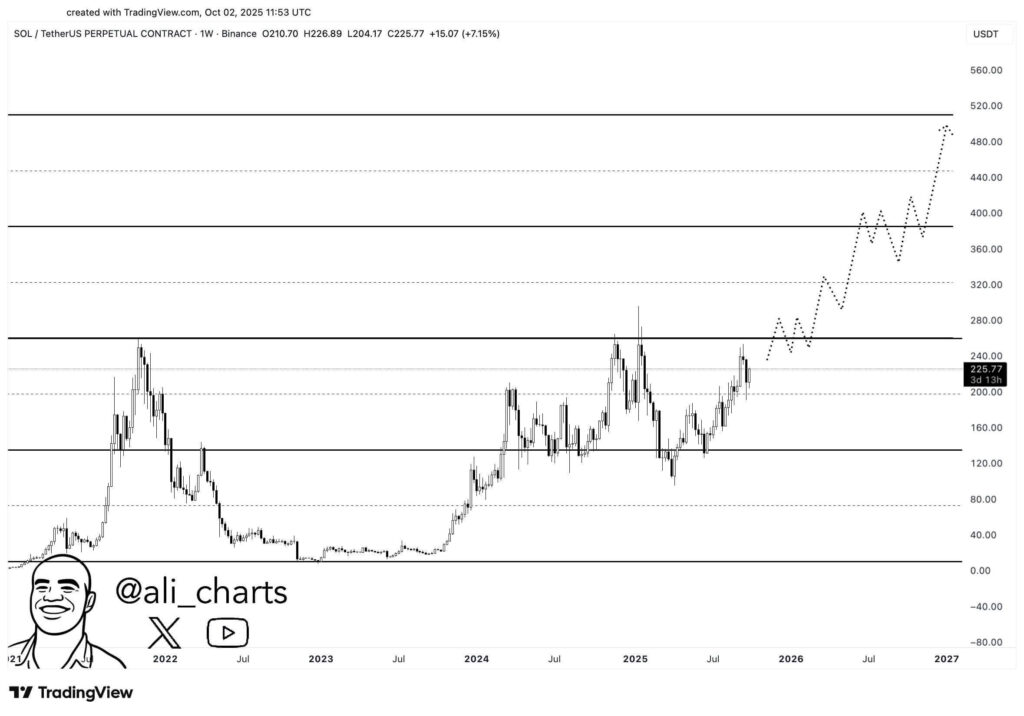

Solana is pressing against one of its most watched resistance zones this week, and analysts are outlining distinct outcomes depending on how the coming candles close. According to analyst Ali, a decisive weekly finish above $260 could unlock an extended surge toward $520. That level is just above Solana’s previous peak, establishing it as a potential gateway for new cycle highs rather than a mere retest.

Rising Toward Resistance

Current movement places SOL near the $240 area, a zone repeatedly rejected since early 2025. This now acts as the immediate top. However, should that barrier collapse under sustained buying pressure, mapped targets are clearly defined.

Ali’s outlined outlook places advancement through $280, $320, $360, $400, $440, and finally $520. Each step aligns with historical congestion ranges and Fibonacci style predictions, suggesting measured pauses rather than erratic climbs.

The nearest support is around $160, giving buyers a defined defensive level. Beneath it, deeper stops emerge at $120 and $40, zones previously used for aggressive accumulation during earlier consolidations. These levels suggest a structured outlook rather than disorderly volatility.

Analysts Offer Two Distinct Approaches

While Ali’s framework focuses on key closes, analyst ZYN proposes a more mechanical strategy. He points to a repeated pattern visible since Q2. According to his observations, buying every 25% pullback and exiting after a 50% to 60% rebound has delivered three consecutive profitable cycles.

Notably, both strategies imply discipline rather than impulsive chasing. However, they operate on different triggers. One depends on macro confirmation through weekly candle structure, while the other depends on recurring percentage swings within the broader range.

Structure Progression Outlook

Projected surge does not assume straight acceleration. Instead, outlined resistance levels imply phased pauses at each checkpoint. Such outlook often show redistribution phases where earlier buyers exit while late participants enter, maintaining directional order.

The next weekly close is important. A confirmed break above $240 would place Solana inside Ali’s mapped outlook toward $260 and beyond. However, rejection at current levels increases the likelihood of rotation toward the $160 to $120 pocket before any renewed attempt.