- Ethereum’s treasury share jump to 4.1% shows growing trust from big investors shifting focus from Bitcoin to DeFi-backed assets.

- The GENIUS Act boosted on-chain finance confidence, sparking major Ethereum accumulation across institutional treasuries.

- Rising ETH, BTC, and SOL holdings mark a new era of multi-chain adoption as institutions diversify beyond traditional assets.

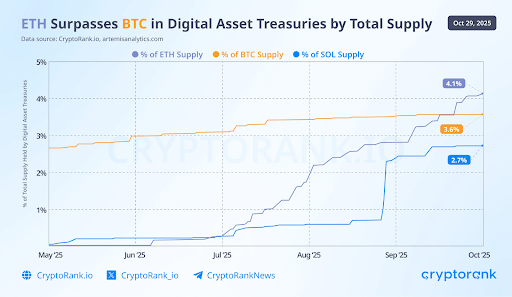

A major shift is unfolding in the crypto landscape as Ethereum overtakes Bitcoin in institutional treasury holdings for the first time. Ethereum currently leads with 4.1% of its entire supply stored in digital asset treasuries, outpacing Solana’s 2.7% and Bitcoin’s 3.6%, according to CryptoRank. This is a turning point for the market since it shows that institutional trust in Ethereum’s long-term position as the foundation of decentralized finance (DeFi) is expanding.

The surge in ETH accumulation gained momentum after Donald Trump signed the GENIUS Act, a landmark stablecoin regulation that boosted on-chain finance confidence. The new law provided legal clarity for blockchain-based financial operations, encouraging large institutions to expand their Ethereum positions. “Ethereum now leads with 4.1% of total supply held by institutional treasuries,” CryptoRank reported, emphasizing the scale of this transition.

Ethereum’s Accelerating Growth

From May to October 2025, Ethereum’s treasury share rose from around 1% to 4.1%. This consistent increase shows sustained institutional demand. The chart from CryptoRank and Artemis Analytics highlighted that ETH’s growth sharply accelerated in June and continued through late October. Moreover, this trend pushed Ethereum past Bitcoin by September, maintaining leadership into the fourth quarter.

In contrast, Bitcoin showed moderate accumulation at that time, growing consistently from 2.8% to 3.6%. Although investors seem to be diversifying, its status as a principal reserve asset is still solid. Solana’s increase from less than 0.5% in May to 2.7% in October was equally impressive. As a result, this collective movement is indicative of a larger market trend among institutional players toward multi-chain exposure.

Ethereum’s expanding share highlights its transformation from a programmable network to an institutional-grade infrastructure asset. Besides, its dominance in DeFi, NFTs, and tokenized assets continues to attract treasury managers seeking exposure to on-chain yield and growth. Furthermore, Solana’s progress illustrates the growing appetite for faster and scalable blockchain ecosystems.