- Ethereum defended the $4,200 support despite heavy ETF outflows, maintaining bullish market stability.

- BlackRock’s ETHA recorded $44.16M inflows, driving institutional demand while Grayscale faced $4.6B outflows.

- Analysts track $4,487 resistance as the breakout level that could send Ethereum toward $4,840.

Ethereum has maintained strong stability above the $4,200 level, even after September 5 recorded the second largest ETF outflow in history. Despite heavy selling pressure, the asset’s resilience has kept momentum intact, with analysts now turning attention to the $4,487 level. A successful reclaim could set Ethereum’s path toward $4,840.

Ethereum Holds $4,200 Support Amid ETF Outflows

According to Axel Bitblaze, ETH held $4.2K like a rock even after Sept 5th delivered the 2nd biggest ETF outflow in history. Market charts confirm that Ethereum maintained its accumulation zone between $4,100 and $4,200, preventing a breakdown during the volatility.

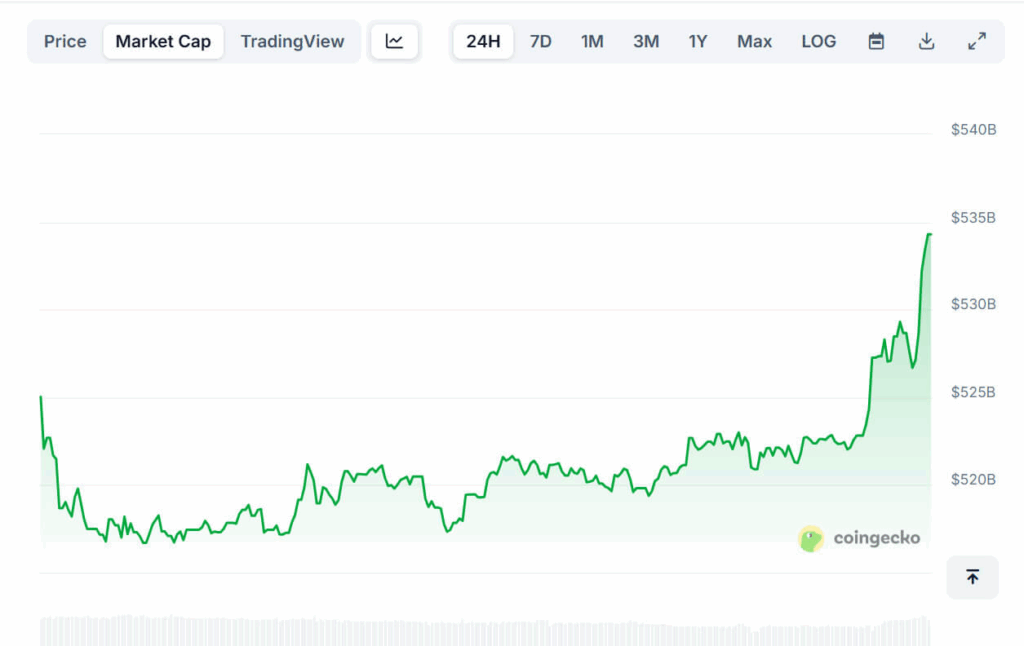

Ethereum traded at $4,427.63 with a 2.5 percent daily increase, recording a 24-hour trading range of $4,280.00 to $4,426.87. The market capitalization stood at $534.30 billion, reinforcing Ethereum’s position as the second-largest cryptocurrency. Circulating supply matched total supply at 120,704,920 ETH, confirming no new issuance during the period.

Data from Coingecko showed trading activity of $29.16 billion in 24 hours, reflecting strong liquidity across global markets. Market structure displayed steady accumulation at support zones, followed by gradual expansion toward resistance levels. Analysts emphasized that $4,487 remains the key resistance barrier for the next upward move.

ETF Flows and Technical Targets

Ethereum spot ETFs recently returned to positive flows after six consecutive days of redemptions. According to official data, September 9 recorded $44.16 million in net inflows, with BlackRock’s ETHA fund accounting for the entire amount. ETHA now manages $15.76 billion in assets and has accumulated $12.66 billion in historical inflows.

Other issuers, including Fidelity, VanEck, and Bitwise, saw no new inflows during the same period, while Grayscale continues to face cumulative outflows of $4.6 billion. This distribution shows a concentration of demand in top-performing products.

Analyst Kamran Asghar noted that ETH is coiling up and said the next move could be a big one. Technical projections indicate that reclaiming $4,487 as support could trigger a run toward $4,840, aligning with previous highs. With institutional inflows recovering and strong technical support intact, Ethereum’s outlook points to sustained upward progression, provided key resistance levels flip into support.