- Ethereum users now wait 46 days to exit staking while Cardano holders enjoy instant liquidity and whales add to their ADA.

- Cardano’s biggest wallets are growing stronger in 2025 as Ethereum faces record delays that test patience and staking trust.

- ADA whales quietly increase control showing conviction while Ethereum’s long queues highlight the risks of rigid staking systems.

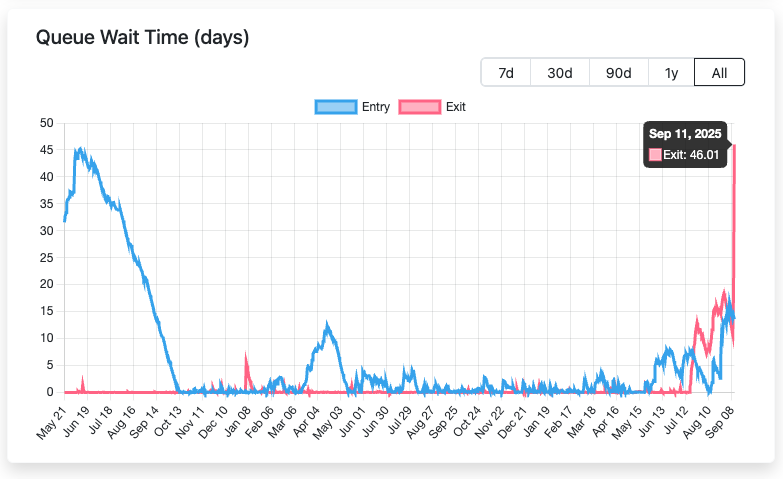

Ethereum users now face a record 46-day wait to unstake their ETH, signaling new stress in staking dynamics. Analysts revealed this sharp delay on September 11, 2025, when exit queues reached their highest level. The sudden surge contrasts with nearly two years of predictable stability.

Cardano supporters quickly pointed out that ADA’s liquid staking design allows instant availability without entry or exit queues. This contrast reignited debate over staking models and long-term efficiency in blockchain systems.

Besides, the latest chart from Cardanians showed three clear phases of Ethereum’s staking queue history. Early tracking in mid-2023 recorded high volatility, with entry times peaking near 45 days before easing.

Source: Cardanians

Moreover, the period between late 2023 and mid-2025 remained stable, with minimal wait times. However, August 2025 triggered a decisive shift. Entry and exit queues started climbing together, and by September, exit times hit an unprecedented 46.01 days.

Cardano Holders Show Renewed Strength

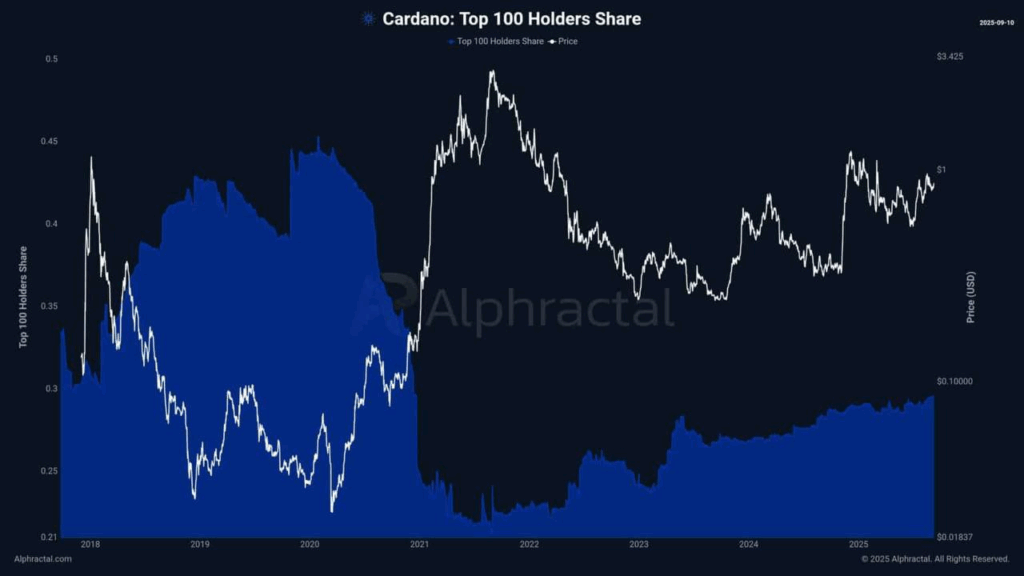

Additionally, Cardano analyst Kamil highlighted that ADA’s top 100 wallets are again consolidating holdings. Data reveals these major wallets expanded control steadily in 2025. Long-term holders also increased their share while short-term supply continued to decline. Hence, growing conviction among big players has become clear.

The concentration history also provides useful context. In 2020, ADA’s top holders peaked at 0.45 shares before slashing their positions in 2021. Prices soared to $3.425 during that period, showing an inverse trend.

Source: Kamil

Furthermore, 2022 through 2024 showed balance, with concentration hovering between 0.25 and 0.28 shares. Now, in 2025, top holders sit near 0.29 shares while ADA trades around $1.

Consequently, the current patterns signal strategic accumulation. Analysts believe these quiet expansions by whales often foreshadow stronger market moves ahead. Moreover, Cardano’s liquid staking system continues to stand out as Ethereum struggles with bottlenecks.

Ethereum’s exit delays expose weaknesses in staking flexibility and liquidity. Meanwhile, Cardano’s design offers investors continuous access to their assets. The sharp contrast strengthens ADA’s narrative as a more user-friendly staking network.

Ethereum faces liquidity pressure as exit times hit records, while Cardano whales accumulate ADA, signaling rising confidence in its model.