- Ethereum’s market value ratio signals potential undervaluation, making it attractive for prospective shareholders.

- Main support at $3,050 and resistance at $4K define Ethereum’s essential trading range.

- Forecasters project Ethereum could climb to $8,400 if bullish momentum sustains into 2025.

Ethereum has caught the attention of investors as crypto analyst Alex Clay discusses a crucial economic moment. According to Alex Clay’s analysis, its current dip below $4,000 could be the last opportunity for investors to buy before a major rally. His technical chart illustrates Ethereum’s long-term bullish potential, emphasizing important support and resistance levels.

Key Levels Indicate Market Movement

Ethereum’s resistance at $4,000 stands out prominently, having been tested multiple times in the past three years. Alex Clay’s chart shows at least five failed breakout attempts at this price since 2021. However, the $3,050-$3,300 range has acted as a robust support zone, preventing further declines during bearish market conditions.

Ethereum remains within an ascending parallel channel, which has defined its bullish trajectory since mid-2022. This trendline suggests the token could rally to $6,500 or even $8,400 in 2025 if it maintains upward momentum. Additionally, green projections on the chart highlight potential long-term growth.

Alex Clay Predicts a $6,500 to $8,400 Rally

Alex Clay’s analysis emphasizes that Ethereum flipping $4,000 into support could trigger an extended bullish rally. Consequently, the $4,000 level becomes critical for Ethereum’s medium- and long-term prospects. His tweet also signals growing confidence among market participants.

“Literally the last train,” Alex Clay wrote, urging investors to consider Ethereum’s potential upside. Other traders, like Twitter user @yellowghOst.eth, also showed optimism, confirming intentions to open long positions.

Historical Price Patterns Confirm Volatility

Ethereum has faced volatility, with sharp corrections and rallies over the past three years. The $4,000 resistance has consistently hindered upward momentum, demonstrating its psychological and technical importance. However, Ethereum’s historical ability to recover from similar corrections adds weight to Alex Clay’s projections.

Moreover, Ethereum’s adherence to its ascending channel reflects a solid bullish structure. This trendline continues to guide price action, even amid market uncertainties.

A Critical Time for Investors

The current market correction offers a pivotal moment for Ethereum investors. Alex Clay’s technical analysis signals that Ethereum’s price is at a turning point. Significantly, flipping $4,000 into support could pave the way for substantial gains.

With Ethereum trading at $3,718, the coming weeks will likely determine whether this correction becomes a missed opportunity or a gateway to new highs.

Ethereum Market Value to Realized Value Trends Highlight Potential Growth

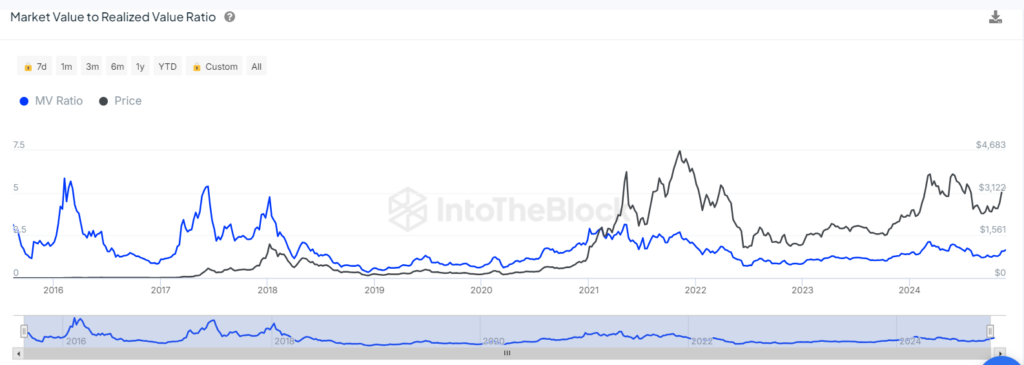

Ethereum’s Market Value to Realized Value ratio has demonstrated shifts, reflecting key periods of overvaluation and undervaluation in its lifecycle. According to the data from IntoTheBlock, the MVRV calculation exceeded 5.0 during the 2017-2018 crypto market boom, indicating extreme overvaluation as the price of Ethereum surged to $1,561.

Following this peak, the MVRV ratio declined sharply, falling below 1.0 during the 2018 bear market when Ethereum’s price plummeted under $100.

This behavior is consistent with market corrections where realized value outweighs speculative market value. By mid-2021, Ethereum’s price reached an all-time high of $4,683, with the MVRV ratio peaking above 7.0, showcasing another period of heightened overvaluation.