- The crypto market just added $200B as renewed hope from US-China trade progress breathes fresh life into investor confidence.

- After years in the shadows, altcoins are finally waking up, with traders seeing this as the start of a brighter, stronger cycle.

- With talk of lower interest rates and big tech earnings on the horizon, excitement is building as crypto’s momentum keeps growing.

The global crypto market is surging today after positive progress in the ongoing US-China trade talks in Malaysia. Traders have responded with renewed confidence as short liquidations soared past $357 million within hours.

Solana, Dogecoin, Ethereum, and Bitcoin have all surged between 3% and 7% as investors expect that Presidents Trump and Xi will soon come to an agreement to ease trade tensions. The cryptocurrency market has seen a surge of around $200 billion due to this confidence, bringing its total value close to $4 trillion.

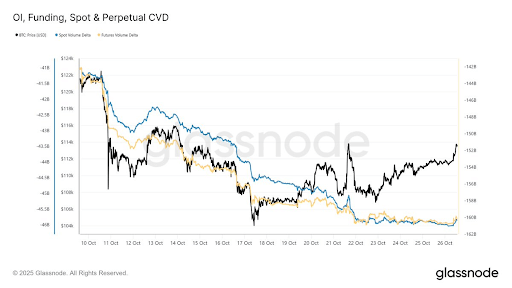

Additionally, after weeks of selling, trading activity has now bottomed out, according to Glassnode’s on-chain data, suggesting that fewer people are selling their currencies. With the help of increased market liquidity and growing confidence in global markets, this suggests that the worst of the selling pressure has subsided and that buyers are once again in control.

Altcoins Revive as Market Structure Improves

According to Michaël van de Poppe, “This has been, by far, the longest bear market ever on Altcoins. It’s been nearly four years of total pain.” He added that comparing this cycle to the previous one “doesn’t make any sense” because “this cycle has been proven to be completely different.”

Moreover, he believes the market is entering “the final easy cycle for crypto” as adoption accelerates and valuations remain mispriced. His technical analysis shows a monthly MACD bullish divergence forming over two years, indicating growing strength. Consequently, Poppe advises investors to “buy blue chips and sit on their hands for a year.”

Macro Tailwinds Add Fuel to the Rally

There’s growing confidence that the U.S. Federal Reserve will cut interest rates by 0.25% at its next meeting, with the CME Group’s FedWatch Tool putting the odds at 98%. This expectation comes after inflation showed signs of cooling and as central banks around the world continue easing their policies.

In fact, about 82% of central banks have lowered rates in the past six months — the most aggressive wave of cuts since 2020. Lower interest rates usually benefit Bitcoin and other cryptocurrencies by boosting market liquidity and making it less costly to hold assets that don’t pay interest.

Additionally, Microsoft, Google, Meta, Apple, and Amazon, which are big tech companies, are set to release their earnings this week. If their results are favorable, it could boost investor confidence and keep the market’s upward momentum going.