- Bitcoin whales dumped over 100K BTC pushing reserves to 7 year lows while institutions and nations kept quietly buying the dip.

- Despite whale selling and cooling ETF inflows Bitcoin still trades between 104K and 116K with demand showing strong resilience.

- History shows institutional adoption can outweigh whale exits suggesting Bitcoin’s long term cycle still holds bullish potential.

Bitcoin is facing heavy selling pressure after whales dumped over 100,000 BTC in the past month. This marked the largest sell-off since 2022 and sent their reserves to seven-year lows.

Consequently, the world’s largest cryptocurrency is trading at $110,730, down 1.45% over the last 24 hours. Meanwhile, institutional players and even some governments continue accumulating Bitcoin, creating a striking divergence in market behavior.

The global crypto market cap now stands at $3.81 trillion, reflecting a 1.34% daily decline. However, trading volumes climbed to $137.23 billion, showing a 4.38% increase. Hence, despite downward pressure, market participation remains active.

According to CoinMarketCap, Bitcoin’s trading volume hit $48.44 billion within the past day, keeping liquidity strong.

Whale Reserves Drop as Selling Accelerates

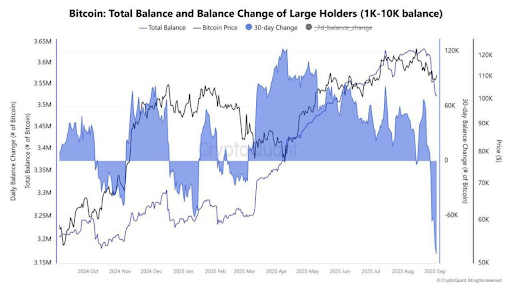

Crypto analyst Crypto Jargon highlighted that whale balances are now back to 2018 levels. Their holdings currently total near 3.15 million BTC, down from 3.4 million earlier this year. August and September 2025 saw aggressive distribution phases, driving balances lower as prices slipped under $110,000.

Source: Crypto Jargon

Previously, the chart shows whale populations increased substantially between late 2024 and April 2025. At the time, prices soared toward $110,000, and balances surpassed 3.35 million Bitcoin. However, after Bitcoin approached $120,000 in May, profit-taking began, which lowered accumulation rates and has led to recent decline.

Institutions and Nations Step In

Institutions continue to be aggressive buyers even though whales are decreasing exposure. Despite growing expenses, institutional stockpiling drove Bitcoin higher on several occasions between October 2024 and April 2025. Furthermore, throughout recent difficulties, nations have subtly increased their reserves, strengthening their long-term belief.

According to Jargon, a declining whale balance does not necessarily indicate that a cycle is over. Whale selling was countered by institutional adoption in previous bull markets, which ultimately led to record highs. Although ETF inflows have slowed and futures funding rates have dropped, the market is nevertheless supported by structural demand.

Bitcoin now trades between $104,000 and $116,000. A break below risks a fall toward $93,000, while a breakout above could reignite bullish momentum.

Whales may be cashing out, but institutions and nations are still stacking, suggesting Bitcoin’s long-term cycle remains far from over.