- Bitcoin trades near $113K within a broadening wedge, with resistance forming around $122K.

- On-chain and DeFi data show rising network activity and liquidity supporting Bitcoin’s upward momentum.

- Analysts note $110K as key support, with a breakout above $122K possibly leading to record highs.

Bitcoin (BTC) continues to trade within a broadening wedge structure on the daily chart, maintaining strong momentum near upper resistance levels. Price movement has expanded between $95,000 and $125,000 since mid-2025, showing rising volatility. At the time of writing, Bitcoin trades around $113,800, reflecting stable upward pressure and growing market participation.

Bitcoin Trades Near Key Resistance as Pattern Nears Completion

According to analysis prepared by Titan of Crypto, Bitcoin’s broadening wedge pattern has developed through six major points between June and November 2025. The structure shows expanding swings, with higher highs and lower lows defining its range. The price now moves close to the upper boundary around $122,000, marking a crucial phase before the pattern completes.

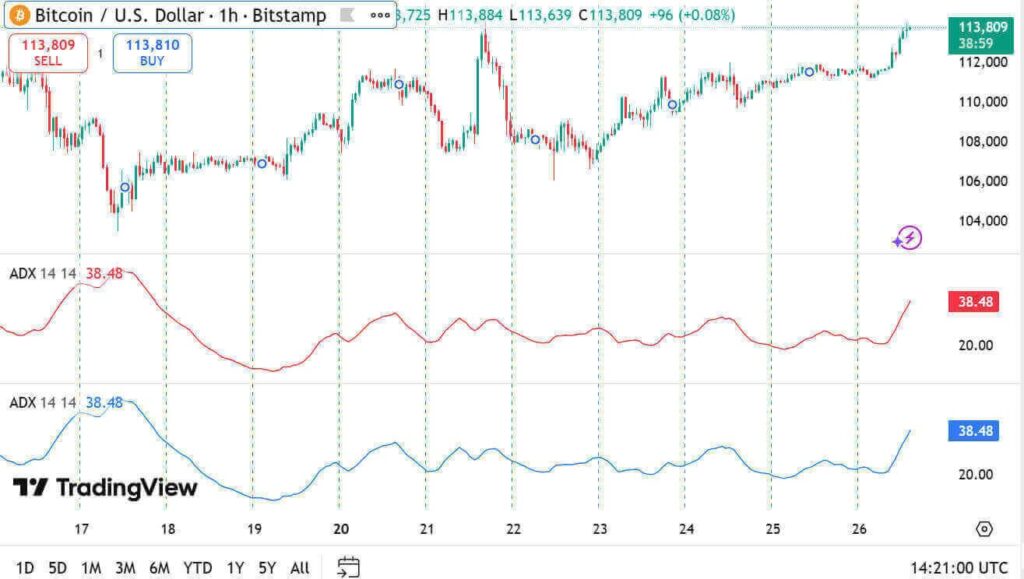

Data from TradingView indicates Bitcoin has fluctuated steadily between $95,000 and $125,000. Each rebound established new highs, while retracements formed deeper lows, shaping the broadening formation. The 1-hour chart reveals upward momentum building following consolidation around $110,000. ADX indicator is reading 38.48, showing the strengthening of trend direction

Trading volume has supported these movements, confirming stable liquidity across major exchanges. The broader market environment also remains favorable. The most recent U.S. Consumer Price Index indicated an annual increase of 3%, slightly lower than the projections. This softened the inflation reading which supported the equity markets, and hence, assisted the digital assets to maintain their bullish tone.

DeFi Growth and Market Liquidity Support Positive Outlook

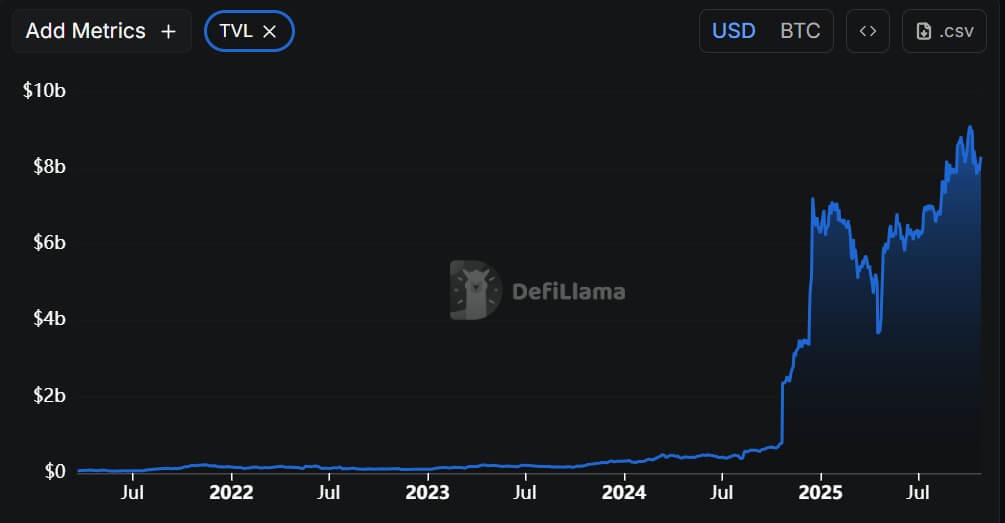

According to data from DeFiLlama, Bitcoin’s total value locked (TVL) in decentralized finance has reached $8.29 billion, a 2.31% increase in 24 hours. The metric has since increased upward since below $1 billion early in 2024 and is steadily growing on blockchain-based platforms with Bitcoin as collateral.

Chain data shows daily fees and revenues totaling $241,487, with token incentives of $97.21 million, reflecting active network engagement. Active addresses reached 595,504, and daily inflows stood at $1,618, confirming sustained participation.

The heat maps of market liquidity indicate that the market is busy between 114,000 and 116,000, which may appeal to new bids. Should Bitcoin continue and surge past resistance of around $122,000, then it may be able to revisit its all-time high in November. Stable trading above $110,000 holds the structure intact setting the stage for possible continuation to record territory.