- Puell Multiple Discount Zone reflects prolonged miner revenue compression and structural selling pressure.

- Miner reserves continue declining, confirming balance-sheet-driven Bitcoin distribution.

- Historical averages suggest the Discount phase remains incomplete, favoring sideways-to-down price action.

Puell Multiple Discount Zone defines the current Bitcoin cycle phase, showing miner revenue compression and persistent distribution. Historical patterns indicate extended consolidation rather than an immediate trend reversal.

Miner revenue compression reshapes market structure

The Puell Multiple Discount Zone shows Bitcoin miner revenue remains well below historical averages. This condition signals economic stress, not short-term panic.

Price drifts lower while the indicator remains firmly in the Discount range. CryptoQuant analyst Gaah notes that Discount phases last about 200 days historically.

Present positioning suggests the market is roughly halfway through this duration. This timing reframes expectations from immediate recovery to gradual adjustment.

Price movements reflect this slow adjustment process. Discount zones correlate with choppy, range-bound price behavior.

Bitcoin struggles to maintain breakouts while volatility compresses. The market digests previous expansions, producing slow, steady downward pressure.

Selling pressure stems from operational requirements rather than panic. Miners liquidate reserves to cover costs and service debt.

Supply enters the market gradually, sustaining the Discount-phase dynamics. This process explains why price declines feel prolonged.

Market participants experience exhaustion rather than sharp shocks. The Puell Multiple confirms this is a time-driven adjustment phase.

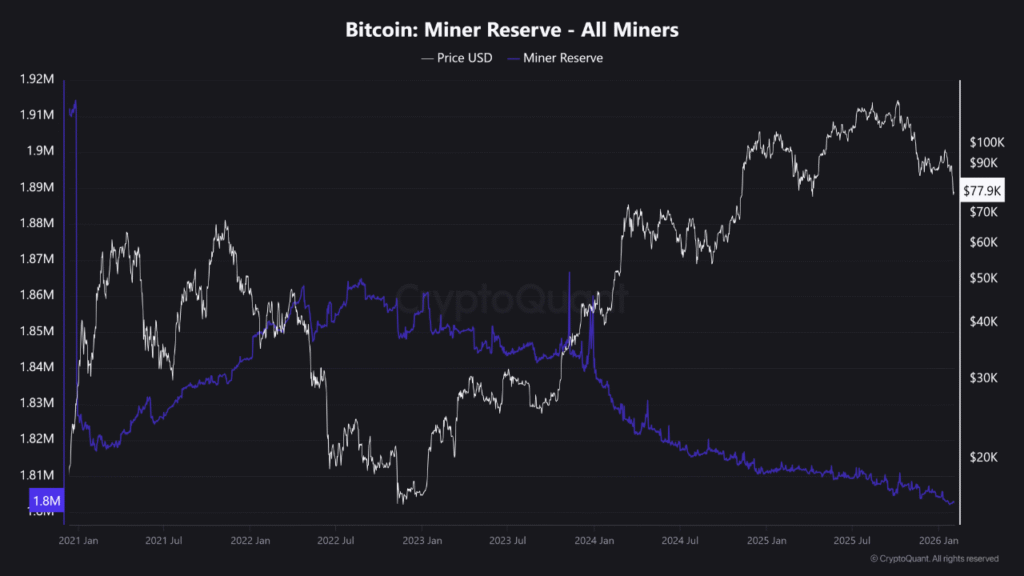

Miner reserves reveal balance-sheet driven distribution

Miner reserves sit near 1.8 million BTC and continue a multi-year downward trend. This decline indicates miners are net distributors rather than long-term accumulators.

Reserve drawdowns confirm selling is necessity-driven. Recovery attempts provide liquidity for miners, reinforcing resistance during short-term price rallies.

Analysts note that each price bounce funds’ operational cash flow. Hashrate pressure grows when profitability declines.

Smaller firms shut down machines, while larger miners restructure operations. The combined effect sustains slow downward pressure without sudden crashes.

The relationship between mineral reserves and the Puell Multiple forms a feedback loop. Reduced revenue triggers reserve selling, limiting momentum, and prolonging sideways-to-lower price trends.

Time-based cycles dominate near-term price behavior

Discount phases rarely end early. Bitcoin trades sideways or drifts lower until miner stress abates. Time becomes more critical than catalysts in this phase.

Accumulation typically occurs near the end of the Discount phase. Mid-cycle positioning frustrates bulls and bears alike, weakening market sentiment through consolidation.

Current data shows the Puell Multiple remains below historical averages and trends sideways-to-down. Bitcoin remains in a structural selling phase, with supply outweighing demand.

Long-term trends indicate stress phases precede opportunities. The Discount Zone is a preparation stage rather than a signal for immediate reversal. Markets require patience as miners complete distribution.