Meta Description: Bitcoin stays steady in October 2025 as selling increases, profits dip, and more coins return to the market.

- Bitcoin traders are selling more this month, but the market still looks calm with no major panic signs.

- Profits have gone down as prices cooled, showing investors are being careful and locking in gains slowly.

- Fewer long-term holders are keeping their coins, meaning more Bitcoin is now moving back into the market.

Bitcoin’s market activity in October 2025 shows growing caution but no signs of panic. According to Swissblock, the “Risk-Off Signal was ticking higher all week, indicating selling pressure.” The firm added that while selling remained strong earlier in the month, it was “nowhere near capitulation levels.” Activity has since eased, suggesting that investors are staying cautious ahead of key inflation data. The report points to resilience across the market despite temporary stress.

Profit and Loss Patterns Reveal Investor Behavior

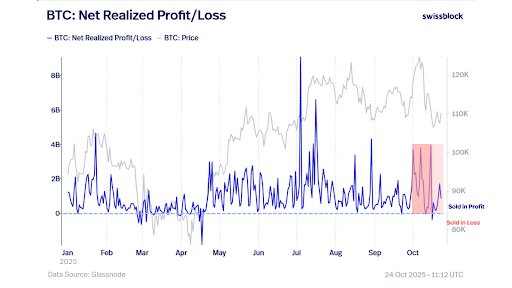

Swissblock’s chart, titled “BTC: Net Realized Profit/Loss,” tracks Bitcoin’s realized gains and losses throughout 2025 using Glassnode data. Early in the year, Bitcoin’s realized profits swung between positive and negative zones. Between January and February, profits peaked near $4 billion as Bitcoin’s price climbed above $100,000. However, by March, realized losses briefly overtook profits, signaling cooling momentum as prices corrected.

From April to June, profit and loss levels alternated sharply, showing increased trading activity during market pullbacks. In July, realized profits spiked above $8 billion as Bitcoin rebounded toward its yearly highs. This strong phase continued through August, though fluctuations gradually narrowed.

By September and early October, realized profits declined as Bitcoin’s price dropped from around $120,000 to near $100,000. The red zone on the chart marked a period of dominant losses as more traders sold below cost.

Illiquid Supply Shows Market Adjustment

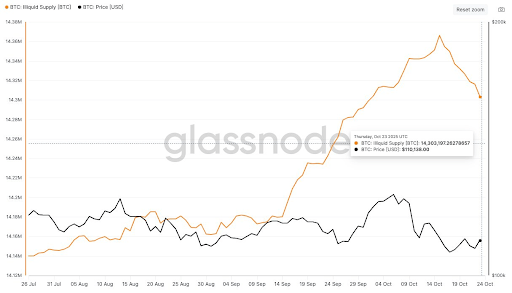

According to Glassnode, roughly 62,000 BTC moved out of long-term inactive wallets since mid-October. The firm noted that “when illiquid supply falls, more coins are available to trade, which can make it harder for price to trend without strong new demand.”

Bitcoin’s illiquid supply increased from 14.12 million BTC to 14.38 million BTC between late July and early October, indicating significant buildup. However, as some investors took profits, ownership began to decline after early October. Bitcoin’s price holding steady at $110,000 indicates that, despite a small easing of supply, sentiment remained neutral.