- Nearly 6B XRP realized near $0.47 is the strongest structural base in the current distribution range.

- Supply void between $2.51 and $2.66 suggests limited resistance before heavier clusters at $2.73 and $2.95.

- Javon Marks predicts a $4.83 extension after XRP broke a long term descending resistance trendline.

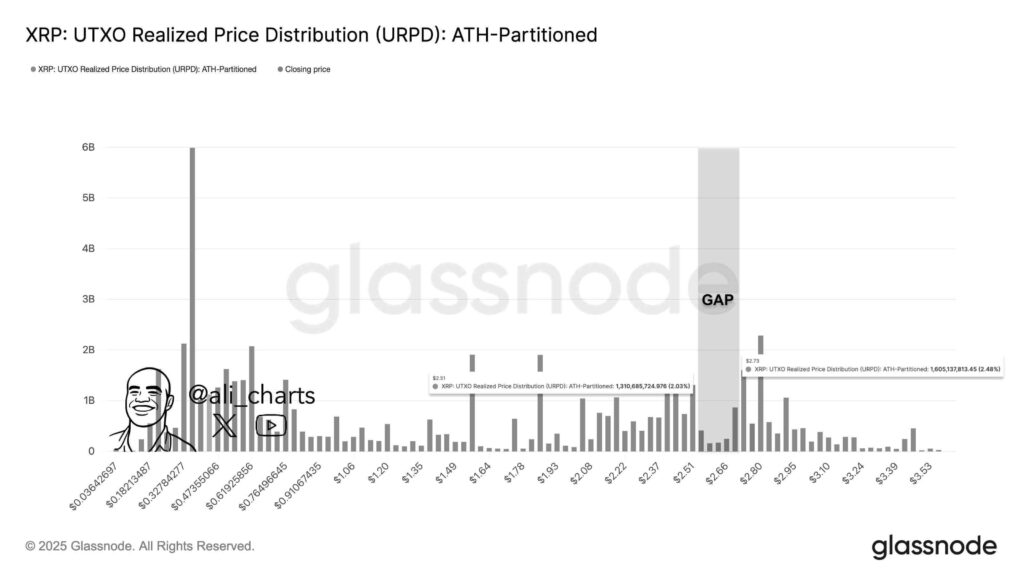

XRP technical assessments noted a rare price vacuum above the mid $2 range. According to analyst Ali, XRP’s UTXO Realized Price Distribution chart, which maps where coins last moved, shows an unusually thin supply band between $2.51 and $2.66.

Historical price clusters indicate where holders accumulated or exited, and this particular gap stands out due to the lack of trading activity in that region. Notably, the distribution shows a heavily concentrated support between $0.37 and $0.47, with nearly 6 billion XRP realized near $0.47.

This establishes it as XRP’s strongest structural base. Another weighty accumulation zone is between $0.18 and $0.27, representing deeper cycle entries. Above these zones, realized supply becomes increasingly fragmented across $0.75, $0.91, $1.06, $1.64, $1.78, $1.93, and $2.08, suggesting wavy resistance layers.

Mid $2 Gap and Potential Acceleration Zone

As noted by Ali, the absence of historical supply between $2.51 and $2.66 creates what he described as a “price gap.” Thin realized activity in that region implies limited overhead resistance, meaning cleared entry into that band could invite fast continuation.

However, once approaching $2.73, where 1.6 billion XRP sit, supply thickens again. Another notable concentration appears near $2.95, setting the final barrier before a retest of historical levels between $3.10 and $3.39.

This aligns with a separate assessment from analyst Javon Marks, who observed XRP breaking out of a long term descending resistance trendline formed from previous cycle highs. That breakout stemmed from multiple rounded bottom structures, which reflected consistent accumulation before each advance.

Structure Breakout

Marks mapped XRP’s retracement into a short term descending channel following its peak near $3.35. Despite the cooldown, he labeled the setup as continuation based rather than corrective. His projected extension target is at $4.83, derived from a measured move calculation and Fibonacci confluence.

The oscillator within his chart formed higher lows, supporting the rounded bases observed in price. Previous oscillator upturns preceded impulsive rallies, adding weight to the ongoing basing phase.

Key Levels and next XRP Levels

Short term structure places $2.50–$2.70 as the immediate support range, shared across both analyses. However, broader interest now is on whether $2.51 can be reclaimed with conviction. If the gap toward $2.66–$2.73 clears without major sell pressure, focus would be on $3.00–$3.35, where both analysts aligned on breakout confirmation zones.