- AVAX struggles near $49, with resistance at $55–$57; Fibonacci levels suggest support at $41 and $36 for potential rebound.

- Bearish indicators dominate short-term trends, with RSI at 40.14 and MACD confirming waning momentum below neutral levels.

- A breakout above $57 could target $94–$118; failure may push prices to $45 or key support zones at $41 and $36.

Avalanche (AVAX) faces critical resistance as it trades at $49.13, a 3.31% decline from its recent high. According to analyst Ali, the price needs to reclaim the $55–$57 zone to unlock its bullish potential. Ali suggests targeting the $41–$37 range for accumulation, aiming for a surge toward $94–$118.

Descending Trendline Limits Price Action

A long-term descending trendline, originating from AVAX’s all-time high of $146, continues to cap upward movement. Repeated attempts to breach this resistance have failed, with the most recent rejection near $55–$57. This rejection is complemented by the appearance of a red weekly candle.

Meanwhile, Fibonacci retracement levels from the $17.27 low to the $55.76 high indicate key support zones. The 0.618 Fib level at $41.06 and the 0.5 level at $36.52 align with Ali’s suggested accumulation range.

A sustained break above the $55.76 high could target Fibonacci extensions at $94.25 and $118.04. However, current price action shows profit-taking near resistance, as traders monitor broader market trends for direction.

Bearish Indicators Dominate Short-Term Chart

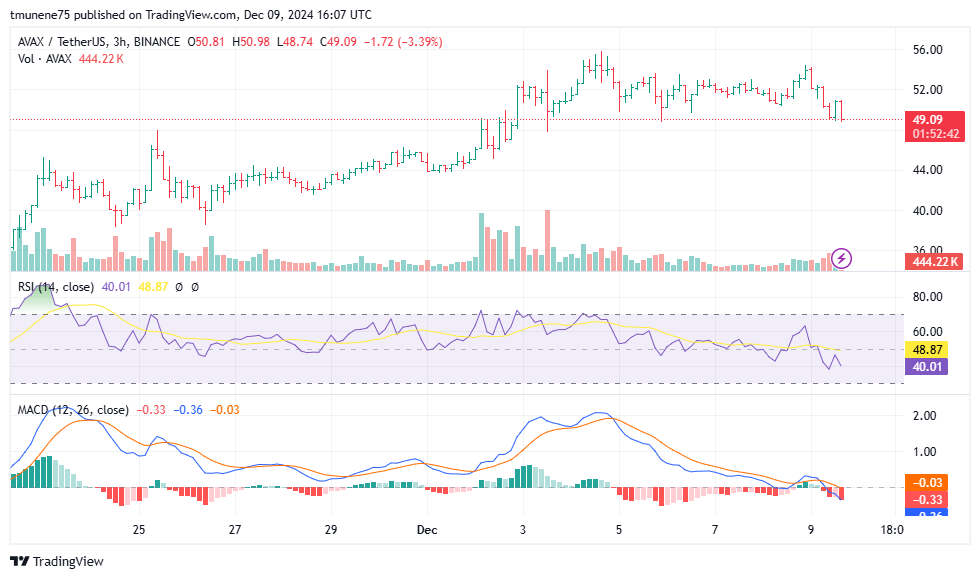

A 3- hour chart confirms a bearish setup, with the MACD and RSI reflecting waning momentum. The RSI, at 40.14, is below the neutral 50 level but not oversold, signaling room for further downside. The MACD histogram indicates strengthening bearish momentum, with the MACD line (-0.33) below the signal line (-0.03).

Immediate support at $48.50–$49.00 appears fragile, with a breach likely to push prices toward $46.00 or $45.00. Conversely, reclaiming $50.50–$51.00 could provide short-term relief, though stronger resistance looms at $52.50.

Support and Resistance Levels Define the Trend

AVAX’s medium-term structure shows consolidation between $48.50 and $52.50. A breakout in either direction could dictate the next significant trend. However, the overall movement remains bearish for now, as lower highs and lower lows persist on this timeframe.

Key support at $41 aligns with the 0.618 Fibonacci retracement, while $36.52 serves as a crucial fallback zone. Resistance at $55–$57 remains the gateway to a bullish continuation, with volume spikes necessary to confirm potential breakouts.