- Ethereum has broken obstacle levels and signals positive changes with a projected price hike to $10K.

- Increased sales activity and rising demand drive Ethereum’s price surge, boosting investor confidence in its market outlook.

- The economic recovery strengthens Ethereum’s momentum as it gains traction in distributed finance and blockchain growth.

Ethereum has jumped past resistance levels and shows appetite for a selling spike toward $10K. The breakout occurred after the token broke out of a symmetrical triangular formation, which had constrained its movement for over two years. This move signals growing confidence in the digital asset sector as traders anticipate more upward momentum.

The recent surge is being closely watched as the coin clears the $4,000 range, which has been a resistance point. This milestone suggests that Ethereum could continue its upward trajectory in the coming months and establish new price records.

Symmetrical Triangle Pattern Confirms Bullish Trend

The symmetrical triangle pattern that constrained Ethereum’s price action since early 2021 has finally been broken. This formation often signals major price moves once a breakout occurs, and Ethereum’s recent move aligns with this expectation.

Ethereum’s ability to break through the $4,000 resistance range has strengthened market sentiment and encouraged buying activity. This level previously acted as a barrier, capping several price rallies over the past two years.

Additionally, the breakout occurred alongside increased trading activity, which reflects market interest and supports the bullish case. Analysts now project Ethereum’s price could reach $10,000, with the symmetrical triangle’s height offering a potential price target for the rally.

Broader Implications for Ethereum’s Market Outlook

The token’s rising move comes at a time when the virtual currency economy is showing signs of recovery and renewed investor interest. Besides breaking resistance, Ethereum continues to benefit from its growing use in autonomous finance and non-fungible tokens, which drive demand for the digital asset.

The rally could also attract corporate investors who see Ethereum as a key asset in their portfolios. However, some analysts warn that potential pullbacks may occur if Ethereum fails to establish solid support above $4,000.

While the token’s trajectory looks promising, technological uncertainties or external economic conditions could still influence its price movement. Nonetheless, the jump sets the stage for a rally, and traders remain focused on whether the coin can reach the $10,000 mark.

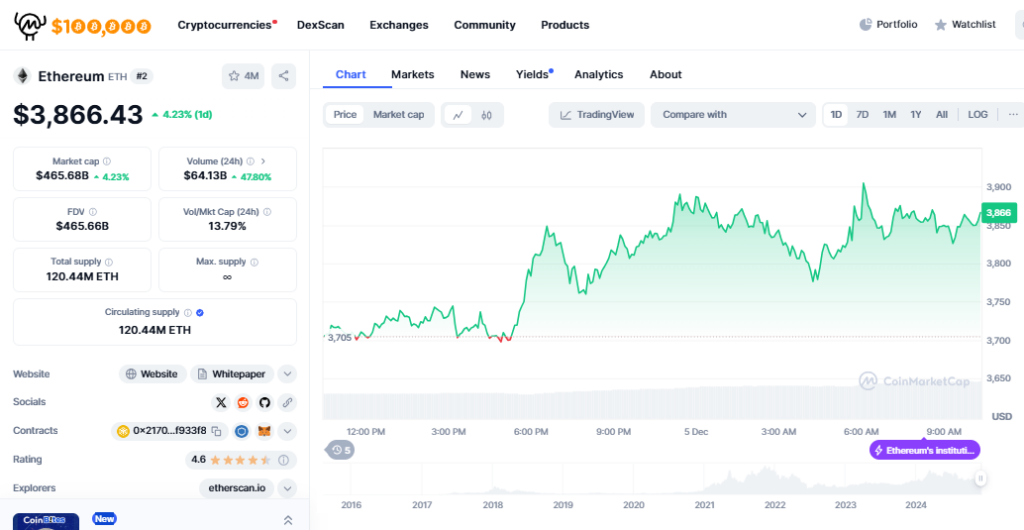

Ethereum Hits $3,866 as Market Activity Surges

Ethereum (ETH) rose 4.23% in 24 hours, reaching $3,866.43 with a market cap of $465.68 billion. Trading volume surged 47.80% to $64.13 billion, with a circulating supply of 120.44 million tokens. Ethereum’s Fully Diluted Valuation remains at $465.66 billion, reflecting strong market fundamentals.

The one-day chart illustrates Ethereum’s steady climb from approximately $3,705 to its current level of $3,866, displaying an increase in sentiment throughout the trading session. This movement comes as the token extends gains made in recent weeks, fueled by growing institutional interest and advancements in its blockchain

The chart shows minor fluctuations during the day, yet consistent upward trends dominate, reflecting sustained buying pressure. The token;s resilience at support levels combined with increased trading activity points toward a potential continuation of this bullish rally. Shareholders and analysts remain optimistic about its ability to maintain its positive momentum as it inches closer to the psychological $4,000 threshold.