- Floki Inu shows a bullish trend with key resistance levels tested and potential for substantial upward movement.

- Strong support levels and EMAs underline Floki Inu’s solid base, boosting confidence in sustained bullish sentiment.

- High trading volumes and breakout patterns signal growing market interest in Floki Inu’s upward trajectory.

Floki Inu ($FLOKI) has surpassed a key price level according to analyst Javon. He highlights that the token is now eyeing $0.00054673 as its next target, suggesting a potential 92.3% upside.

Shifts in Price Trends and Market Structure

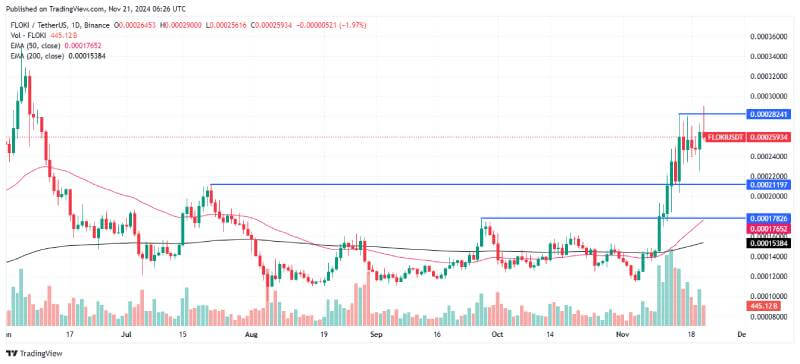

The historical price movement of FLOKI reveals distinct phases. Early movements demonstrated a steady decline, defined by lower lows and falling prices. Notably, this pattern reversed as the asset transitioned into an uptrend characterized by rising highs. During this shift, key consolidation zones emerged, forming patterns like descending wedges. These zones provided the foundation for breakouts, signaling bullish momentum.

Currently, FLOKI’s price has approached a critical resistance near $0.00027148. This level represents a significant test as prior movements suggest the potential for retesting earlier highs. If FLOKI breaks above this resistance, the next level of interest lies at $0.00054673, indicating a near-doubling in value.

Key Levels and Market Dynamics

Resistance and support levels provide further clarity on FLOKI’s price movement. The token recently tested resistance at $0.00028241, where bullish activity briefly slowed. Beyond this point, the $0.00032000 to $0.00034000 range stands as the next target if upward momentum persists.

On the support side, FLOKI is backed by several levels, including $0.00021197 and $0.00017826. These levels align with areas of consolidation seen during previous price movements. Additionally, the 50-day EMA at $0.00017652 and the 200-day EMA at $0.00015384 provide further support, underscoring a solid base for ongoing bullish sentiment.

Indicators Show Strong Momentum

On a daily chart, Floki shows notable trends, including increased buying activity aligned with breakouts. Recent candles show bullish wicks near resistance. High trading volumes during breakout phases further reinforce strong buyer participation.

Prices remain above the 50-day EMA, confirming robust momentum. Meanwhile, the gap between the 200-day EMA and current levels show the strength of the medium-term uptrend. These technical factors collectively suggest potential for FLOKI to test its projected targets if bullish momentum continues.