- VeChain ($VET) broke its descending triangle pattern, flipping the $0.037 resistance into support, fueling bullish momentum.

- Momentum indicators, like MACD, confirm strong buying pressure, with volume exceeding 701Mn.

- Fibonacci retracement highlights $0.03336 resistance, with potential pullbacks to $0.02588 providing opportunities for further accumulation.

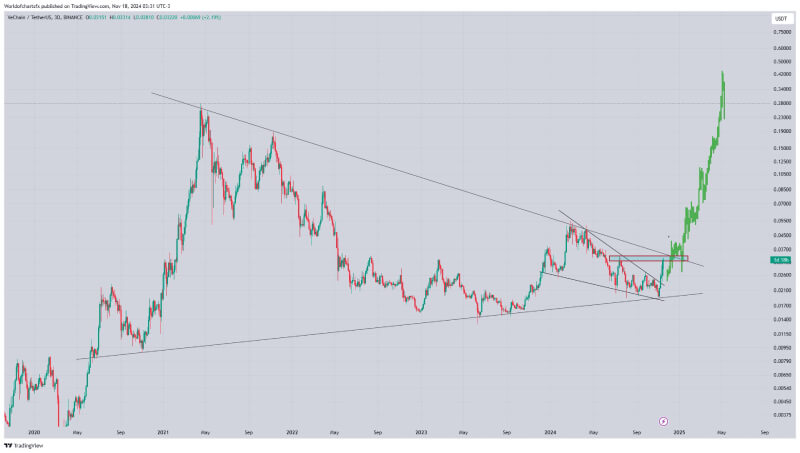

VeChain ($VET) is exhibiting substantial bullish momentum, as recent price movements suggest a potential breakout. Trading at $0.032, VeChain has surged following a prolonged descending triangle pattern that lasted from 2021 to mid-2024.

This pattern, characterized by lower highs and horizontal support near $0.015, broke in mid-2024. Notably, the resistance at $0.037, tested multiple times during the downtrend, has flipped into support, strengthening the bullish narrative.

Key Resistance and Support Levels

The resistance level of $0.037 has emerged as a pivotal zone after its recent transformation into support. Following the breakout, VeChain’s price surged, achieving higher highs and starting further upward movement. Currently, it faces resistance near $0.03336, a critical level that aligns with prior peaks.

Notably, potential support levels include $0.02588 and $0.02385, with the latter coinciding with the 78.6% Fibonacci retracement level. These levels have historically attracted buying interest, reinforcing their importance in sustaining the ongoing uptrend.

Momentum Indicators Signal Continued Bullishness

Momentum indicators, such as the MACD, support the positive outlook. A recent MACD line crossover above the signal line suggests strong buying pressure. Moreover, the expanding histogram in positive territory reflects increasing bullish momentum.

Increased trading volume aligns with upward price movements, further validating the recent breakout. Today’s trading volume exceeds 701.811 million, reflecting heightened market interest as VeChain’s price gains over 10% in a single session.

Fibonacci Levels and Key Price Zones

With the retracement applied from $0.02126 to $0.03336, the price hovers around the 23.6% level at $0.03051, currently acting as resistance. Breaking this resistance could lead to tests of psychological levels such as $0.05 and beyond.

Meanwhile, failure to sustain above $0.03336 may result in a pullback toward support at $0.02588. Historical patterns suggest such corrections often provide opportunities for further accumulation before bullish continuation.

VeChain’s current momentum, supported by strong momentum and robust support levels, positions it favorably for further gains. The increasing price action reflects renewed market confidence, with macro trends playing a crucial role in sustaining the upward momentum.