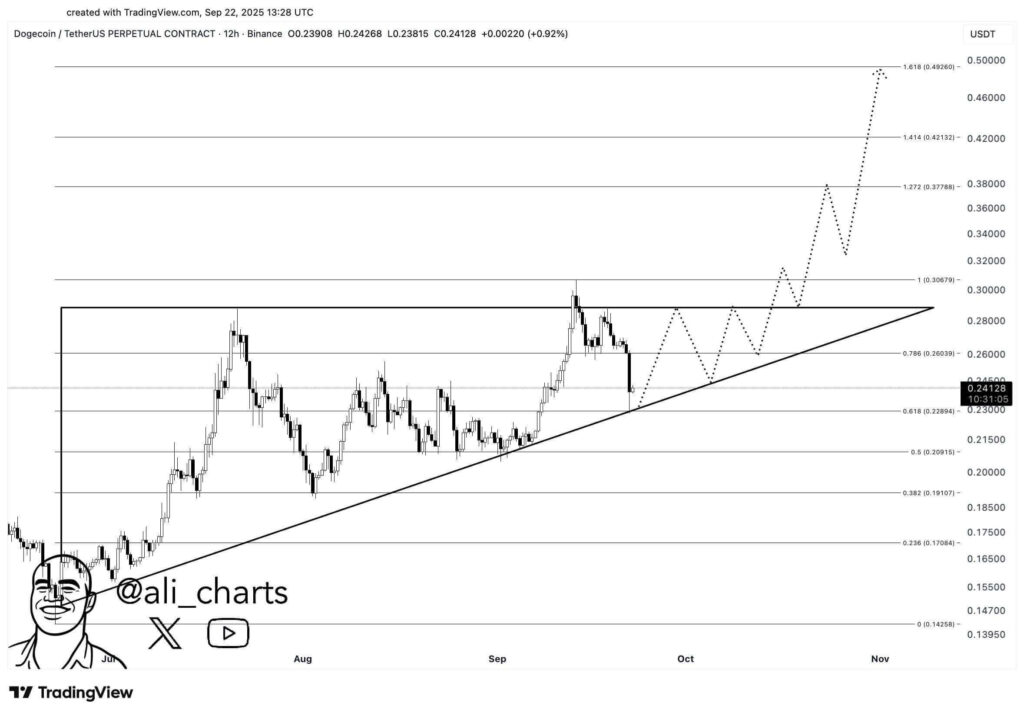

- Dogecoin holds $0.23 support, aligning with a major trendline and 0.618 Fibonacci retracement, creating a strong decision zone.

- Analysts Ali and Swanson highlight $0.31 resistance as critical, with breakout targets at $0.35, $0.38, and up to $0.50.

- Downside risks emerge if $0.23 fails, with potential declines toward $0.2091 at 0.5 Fibonacci and $0.1910 at 0.382 Fibonacci.

Dogecoin is holding near a key price range that could determine its next major move, according to analysts. The crypto is consolidating between $0.23 and $0.24, an area that aligns with both a long term ascending trendline and a key Fibonacci retracement level. Analysts note that maintaining this support could lead to a breakout, with upside targets extending toward $0.50.

Trendline and Fibonacci Levels

The current outlook shows a long term ascending trendline from early June acting as a foundation for bullish momentum. DOGE price has repeatedly tested this support, which now aligns with the 0.618 Fibonacci retracement level at $0.22894.

Immediate resistance Is at $0.26, corresponding with the 0.786 retracement level. Beyond this, price targets include $0.30 at the full Fibonacci extension. If broken, further objectives are at $0.37, $0.42, and $0.49.

Market Pattern and Price Behavior

Analysts note that the price is trading between $0.23 and $0.30, indicating ongoing accumulation. The dotted projection indicates a possible consolidation before a decisive breakout.

Joe Swanson emphasized that higher lows since April continue to support accumulation, suggesting that sentiment has been steadily improving. Swanson also pointed out that $0.23 acts as primary support with $0.20 as backup.

Resistance near $0.31 is key, as a breakout above this level could target $0.35 to $0.38. This sequence places attention on the $0.30679 zone as a key level for directional momentum.

Upside and Downside Scenarios

The bullish case depends on Dogecoin sustaining its higher lows structure above the ascending trendline. If momentum holds, a move above $0.30 may lead toward $0.38 and eventually $0.50, which would represent a near 100% rally from current levels.

However, a breakdown carries risks. Failure to defend the $0.22 to $0.23 region could lead to declines toward $0.20 at the 0.5 Fibonacci retracement. A deeper drop might extend to $0.19, aligning with the 0.382 retracement. This scenario would weaken the bullish setup and change to lower support levels.

According to Ali and Swanson, the price action around $0.23 is decisive for the mid term outlook. Whether the market sustains accumulation or loses support at this level will influence Dogecoin move in the short term.