- Kiyosaki urges investors to buy Bitcoin, gold, and silver before the Federal Reserve cuts interest rates and real assets rise.

- Bitcoin and gold are showing a rising correlation, suggesting they may be treated as safe-haven assets amid market uncertainty.

- Kiyosaki dismisses the debate between gold and Bitcoin, urging action to acquire real assets ahead of the Fed’s anticipated policy shift.

Robert Kiyosaki, the author of Rich Dad Poor Dad, has once again highlighted the impending surge in prices for Bitcoin, gold, and silver. Kiyosaki emphasized that those who continue debating the merits of gold versus Bitcoin are missing the larger picture.

According to him, real assets will skyrocket in value once the Federal Reserve pivots and cuts interest rates. He cautions that assets like U.S. bonds, which he refers to as “fake money,” will lose their value, while tangible assets such as gold, silver, real estate, and Bitcoin will rise.

Bitcoin vs. Gold: Kiyosaki’s Perspective

Kiyosaki dismissed the ongoing debate about whether gold or Bitcoin is the superior asset. He likened it to comparing luxury cars like Ferraris and Lamborghinis while still taking the bus. He argues that focusing on such discussions is futile, as both assets will benefit from the upcoming changes in monetary policy.

He highlighted that those who hold real assets, including Bitcoin, gold, and silver, stand to gain significantly in the near future. Notably, Kiyosaki urged investors to stop talking and take action, emphasizing the importance of owning these real assets ahead of the Federal Reserve’s anticipated shift in policy.

Bitcoin’s Price Trends and Correlation with Gold

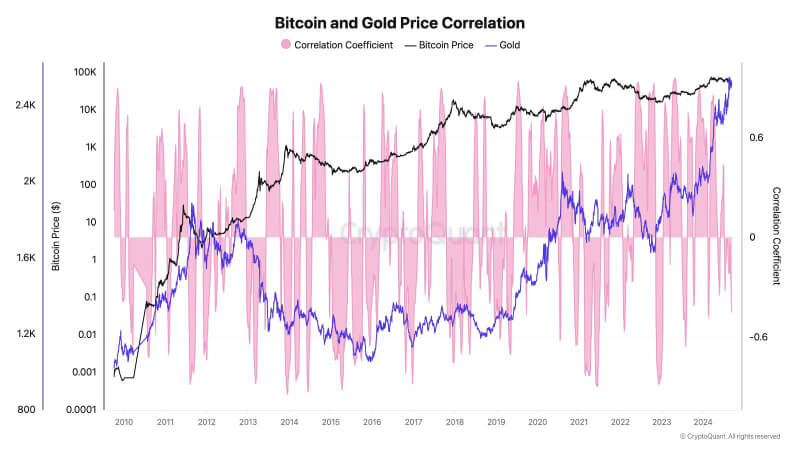

Bitcoin’s price has followed an exponential growth pattern, starting below $0.001 in 2010 and peaking near $65,000 in 2021. By 2024, Bitcoin prices have remained in the $25,000 to $35,000 range, showing resilience despite market volatility.

On the other hand, gold has shown more stability, fluctuating around $1,200 in 2010 and reaching over $2,000 post-2020 due to its safe-haven status. Notably, the correlation between Bitcoin and gold prices has varied, moving between positive and negative values, reflecting both assets’ differing market behaviors.

Rising Correlation Signals Potential Shift

In recent times, Bitcoin and gold have shown an increasing correlation, reaching near +0.6 by 2024. This trend suggests a growing similarity in how both assets move in the market, indicating that investors may increasingly view Bitcoin as a digital equivalent to gold.

However, Bitcoin’s historical volatility and market-specific factors, such as regulatory changes and adoption rates, continue to set it apart from gold, ensuring its price remains driven by unique forces.