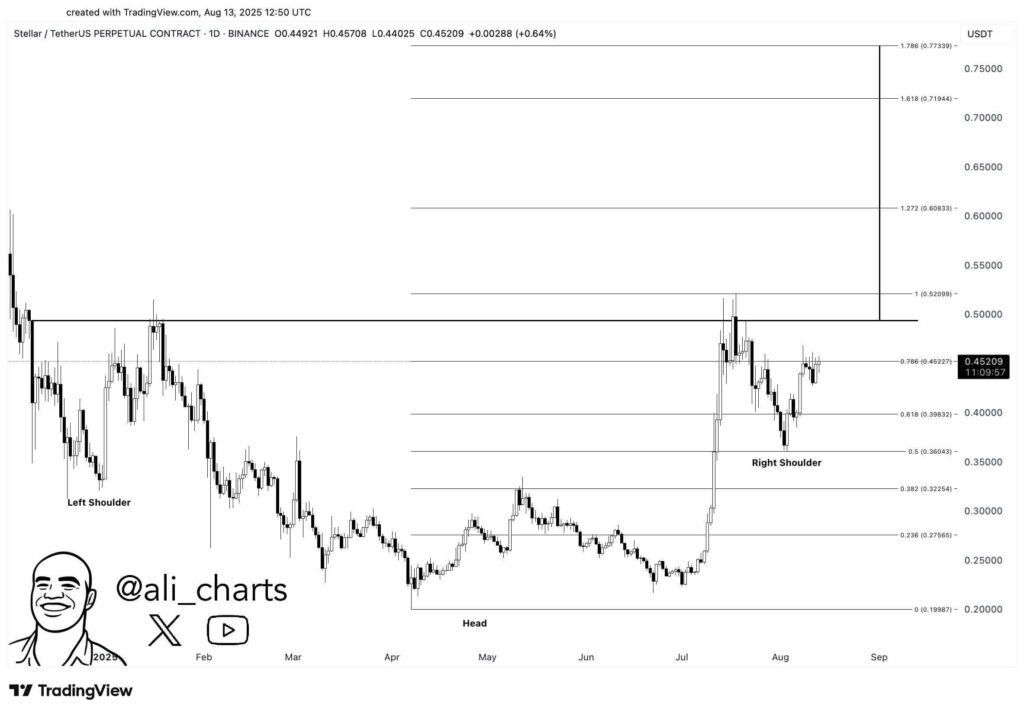

- Stellar forms inverse head and shoulders, with $0.52 breakout potentially targeting $0.60, $0.71, and $0.77.

- RSI at 61.44 and bullish MACD suggest further upside if Stellar clears strong $0.50–$0.52 resistance zone.

- July rally from $0.20 to $0.50, backed by high volume, keeps bullish case intact above the $0.40 support level.

Stellar (XLM) is near a key technical point that could determine its next price movement. The digital asset is testing resistance near $0.50, the market eyeing higher targets if this barrier is broken.

According to analyst Ali, an inverse head and shoulders pattern formed, with a confirmed breakout above $0.52 potentially leading toward $0.60, $0.71, and $0.77. This follows months of structured price action, beginning with January left shoulder formation near $0.45–$0.50, April head at $0.20, and July right shoulder near $0.35.

Defined Resistance and Support

At press time, Stellar was trading at $0.4557 just below the 0.786 Fibonacci retracement level at $0.4523, a notable resistance zone. Fibonacci levels, drawn from the April low of $0.20 to the July peak at $0.52, outline key levels.

These include the 0.618 level at $0.3983, which has acted as strong support, and the neckline at $0.5209. A sustained move above the neckline could validate the bullish reversal pattern, while a drop under $0.35 would weaken the technical case.

Indicators Show Bullish Momentum Building

Market indicators support the possibility of further upside if resistance levels are cleared. The RSI is at 61.44, with its moving average at 55.23, suggesting healthy momentum without entering overbought levels.

The MACD also shows a positive outlook, with the MACD line at 0.0166 above the signal line at 0.0154. A positive histogram reading of 0.0012 indicates strengthening buying pressure following recent consolidation.

Price Action Supported by Volume Strength

Daily trading volume is at 50.65 million, indicating active market participation. The large green volume spikes in July coincided with a sharp rally from $0.20 to over $0.50, suggesting high investor involvement.

Since early July, the price has maintained an uptrend, from the $0.40 support zone after a pullback. This rebound places Stellar within striking distance of the $0.50–$0.52 resistance band, a zone that, if surpassed with strong volume, could lead to the projected targets.