- Whales bought 130M DOGE in 24 hours, with holdings rising to 50.79B during the July rally, indicating strong bullish confidence.

- Despite DOGE falling to $0.21, whale holdings remained steady, showing no major sell off and hinting at long term positioning.

- Persistent exchange outflows post peak suggest reduced sell pressure, with whales continuing to hold despite price retracement.

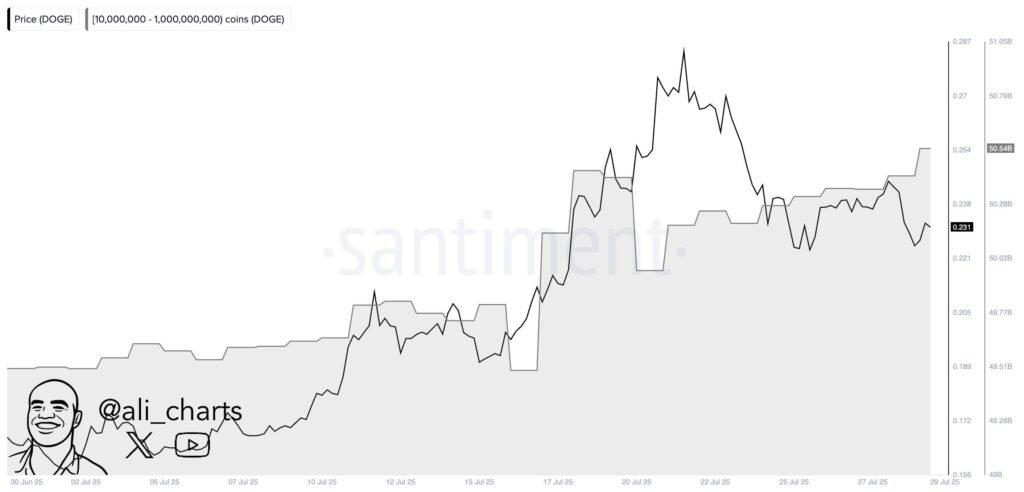

Dogecoin price movements have attracted renewed attention as large holders, often referred to as whales, stepped in to accumulate. According to analyst Ali, whales collectively acquired 130 million DOGE within a 24 hour period.

This activity comes after the price retreated from its mid July highs, raising questions about whale behavior during market corrections. On-chain data shows a surge in accumulation by wallets holding between 10 million and 1 billion DOGE, which aligns closely with key price movements since early July.

Accumulation Surged as DOGE Price Peaked Mid July

From June 30 to July 10, DOGE remained mostly stable between $0.156 and $0.18. Whale holdings during this period hovered around 49.26 billion DOGE, showing no major changes. However, from July 10 onward, both the price and whale holdings had sharp increases.

By July 20, the price peaked near $0.287, while holdings climbed to roughly 50.79 billion DOGE. This spike indicates that large wallets were accumulating during the uptrend.

It shows strong confidence from major holders during the price rally. Between July 18 and 22, outflows dominated, with several exceeding $20 million. These large outflows suggest reduced exchange supply and holding activity, often linked with bullish trends.

Outflows Continued Even as Prices Retraced

Following the July 20 peak, DOGE gradually declined to a low around $0.21–$0.22 by July 28. Despite this retracement, whale holdings stayed high, near 50.54 billion DOGE by July 29. This maintained level suggests that whales did not engage in significant selling during the pullback.

Netflow data between July 23 and July 29 supports this view. Continued outflows, especially on July 24, 25, 27, and 28, some above $30 million, imply ongoing holding or accumulation. These steady outflows reduce the amount of DOGE available on exchanges, limiting potential sell pressure even during a market dip.

Inflow and Outflow Patterns Indicate Whale Intent

Before the mid July rally, net inflows were modest, rarely exceeding $10 million. However, between July 11 and 17, inflows rose sharply, peaking around $50 million to $60 million. This influx coincided with the buildup to DOGE’s rally and may represent speculative positioning by large holders.

During and after the price peak, the dominance of outflows showed a different outlook. Funds were moved off exchanges, hinting at reduced short term selling intent. The divergence between price direction and wallet activity shows a possible decoupling, where large holders maintain positions regardless of temporary corrections.